A GOLDEN MOMENT

November 29, 2013

1BTC:$1120.397100

- Artist

- Andre O'Shea

- Fact Date

- November 29, 2013

- Fact #

- 075

- Printing Specifications

- Paper / Stock

- Tintoretto paper

- Page Size

- 70cm x 35cm

At the tail-end of 2013, Bitcoin briefly surpassed the price of an ounce of gold when it hit $1,242. It was the first time digital scarcity overtook physical gold in price per unit, marking a symbolic shift in how value could be stored. But zooming out told a different story: gold’s market cap stood at $6 trillion, while Bitcoin’s was just $13 billion – barely 0.2%. The real flippening lay ahead – but it was progress nonetheless.

So much happened to Bitcoin in 2013 that it’s easy to overlook that time it overtook gold. It was a fleeting moment, to be fair, a blink-and-you-miss-it price leap that marked the high-water mark of the bull market. Still, the achievement, no matter how evanescent, suggested that perhaps there was something in the digital gold analogy after all. If Bitcoin could surpass the price of an ounce of gold, what other benchmarks could it best?

The fact that BTC and an ounce of gold reached parity for a matter of minutes in 2013 is symbolic. It was two worlds, one digital, the other physical, fleetingly careening off each other on their first encounter like dodgem cars sent spinning in different directions. Their paths would collide again, but this first contact was surface only. And on the surface, there were clear analogies to draw between the two assets, despite their different spheres.

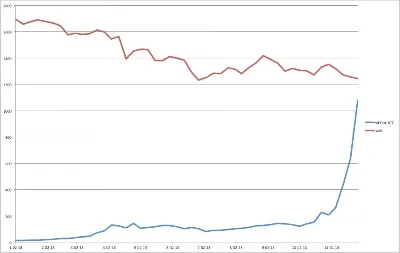

In November 2013, Bitcoin had been in “Up Mostly” mode all year. There’d been a few jittery moments, but having begun the year at $13, BTC had roared past three figures and was showing no signs of letting up. Gold, on the other hand, was having a bad year by its standards – the worst in 30 years to be precise, shedding 30% of its value in 2013.

When Bitcoin and gold intersected, therefore, they weren’t just on opposing paths but were moving in opposing directions.

Ships in the Night

The precise moment when one bitcoin became more valuable than one ounce of gold is a point of historical contention, reflecting the chaotic nature of the cryptocurrency market in 2013. Calculating it is more an intellectual exercise than a historical investigation, since observers of the phenomenon scarcely had time to appreciate it, let alone comment on it.

That moment arrived at a time of peak volatility for Bitcoin – and for gold, whose market was also lively that day by its standards. It was November 29, 2013, and while it can be said with confidence that BTC briefly overtook an ounce of gold, the time at which this milestone occurred is anyone’s guess.

Gold spent the day trading in a range between $1,217 and $1,244. If it were Bitcoin, that would make for a dull day indeed. Bitcoin, for its part, was jumping around like a man possessed during the adjacent days, and November 29 was no different. All that can be said for certain is that on this day in history, an unknown number of traders on Mt. Gox paid more for 1 BTC than their metal-trading counterparts did for an ounce of gold.

Significant as this moment was, at least when examined in hindsight, the comparison of one bitcoin to one ounce of gold is fundamentally an arbitrary one, albeit predicated upon the units used to quote the price of each asset.

Analogies between gold and Bitcoin are almost as old as Bitcoin itself, the most obvious being that both are regarded as stores of value, capable of preserving wealth over time due to their perceived scarcity. Indeed, the only tangible differences are in terms of form: one is physical, the other digital. Neither asset is directly controlled by a central authority such as a government or bank, making them appealing hedges against inflation or currency devaluation, especially during economic uncertainty.

Nevertheless, before 2013, the idea that a string of code could be worth as much as a tangible ounce of the world's most revered precious metal was, for most, absurd. Nevertheless, the event, however fleeting and flawed, provided fuel for the idea of Bitcoin as “digital gold.” It was a powerful demonstration that a purely digital asset, secured by cryptography and governed by an immutable algorithm, could command immense value in the open market.

- Artist

- BTC On this day

- November 29, 2013

- Market Cap

- $13,503,810,127

- Hash Rate

- 5,491.539 TH/s

- Price Change (1M)

475%

- Price Change (3M)

765%

- Price Change (1Y)

8899%