AUCTION OF THE CENTURY

March 30, 2010

1BTC:$0.005472

- Artist

- Arne Spangereid

- Fact Date

- March 30, 2010

- Fact #

- 026

- Printing Specifications

- Paper / Stock

- Xper Paper

- Page Size

- 70cm x 35cm

In its early days, the Bitcointalk forum was awash with creative ideas from early adopters. User SmokeTooMuch is credited with attempting the world’s first bitcoin auction, asking $50 for 10,000 BTC. Surprisingly, there were few takers: the highest bid was $25 and the proposed sale failed.

Most Bitcoin events are famous because they happened. The first Bitcoin auction is famous because it didn’t. Or to be more precise, it is famous because the deal never ultimately went through, despite the good intentions of the auctioneer.

In late March 2010, Bitcoin had gained its first order book exchange and demand for BTC was starting to rise, with new community members especially eager to acquire coins from miners. Those who had been mining for the past few months, when network difficulty and competing miners were both low, had amassed thousands of coins in some cases.

There needed to be an easier way to transfer coins from miners looking to offload them to new users looking to acquire them – preferably in a manner that wouldn’t spike the highly illiquid Bitcoinmarket.com that was now operational.

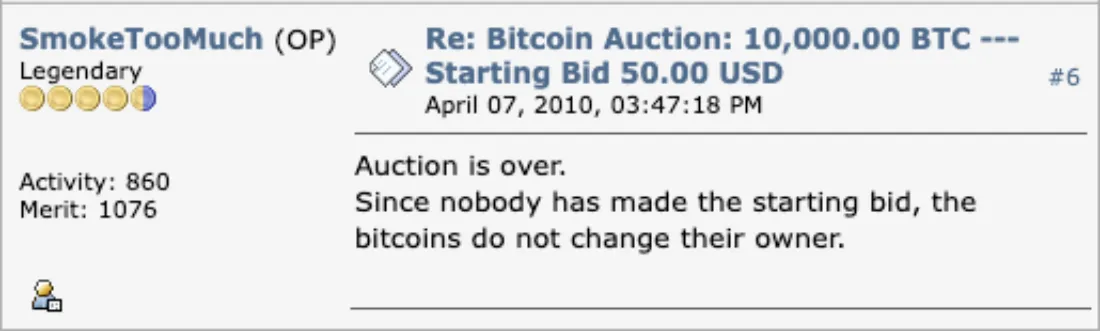

On March 30th, 2010, Bitcointalk forum user SmokeTooMuch decided there was sufficient demand for bitcoin to sell a tranche of coins to the highest bidder and opened a thread titled “Bitcoin Auction: 10,000.00 BTC --- Starting Bid 50.00 USD.” This appeared a fair price, given that 10,000 BTC were then worth around $65, although exchange rates were volatile at the time and pricing data was approximate.

SmokeTooMuch proposed an open bidding auction to run for seven days, during which users could reply in the thread with the amount they were willing to pay. Each bid had to be at least $1 higher than the previous offer.

“After the auction is over,” wrote SmokeTooMuch, “I will pm the highest bidder and will send him 5000 BTC, then I will wait until the bidder has transferred his money to my paypal account and will then send the other 5000 BTC. This is necessary to protect me from false/joke bidders.”

Serious Bids Only

As a concept, the auction was a bold attempt at stimulating interest in bitcoin while offloading a large chunk of coins in one go. A few hours after the thread was created, the ever-involved dwdollar took the bait and placed a bid – but offered just $20 for the 10,000 coins.

While the notion of acquiring that many coins so cheaply seems like the opportunity of the century now, back then it wasn’t perceived that way. In fact, a number of users complained that SmokeTooMuch had set the starting bid too high.

“$50 is somewhat of a high starting bid considering there is over ฿22,000 available for not much more per bitcoin than your starting bid,” wrote NewLibertyStandard. “Not to mention that realistically there's probably a lot more than ฿22,000 available because if somebody bought a bunch of those bitcoins, I'm sure some people would step forward to sell more bitcoins.”

It’s no coincidence that the first two forum users to comment on the price of the proposed auction were highly aware of its market value: dwdollar and NewLibertyStandard ran the only two bitcoin exchanges in Bitcoinmarket.com and New Liberty Standard respectively.

Despite harbouring reservations about the deal, NewLibertyStandard raised dwdollar and offered $20. And then…nothing. Three days passed without attracting any further bids and the auction expired with the minimum price failing to be met. In retrospect, SmokeTooMuch may have been grateful that the coins stayed in his wallet – at least for the time being.

While the auction was technically a failure, it’s another example of early attempts to generate interest in Bitcoin and expand the means of buying it. The non-event also highlighted a major problem at the time, which early exchange operators dwdollar and NewLibertyStandard were only too aware of: fiat onramps were virtually non-existent, and PayPal was sub-optimal for multiple reasons, including anonymity, as one poster in the auction thread pointed out.

If demand for bitcoin was to significantly increase, two things would need to happen: there needed to be more places to buy it – and more fiat options.

- Artist

- BTC On this day

- March 30, 2010

- Market Cap

- $13,099

- Hash Rate

- undefined TH/s

- Price Change (1M)

3%

- Price Change (3M)

751%