BITLICENSE

January 28, 2014

1BTC:$833.939500

- Artist

- Franky Nines

- Fact Date

- January 28, 2014

- Fact #

- 079

- Printing Specifications

- Paper / Stock

- Favini Tokyo paper

- Page Size

- 70cm x 35cm

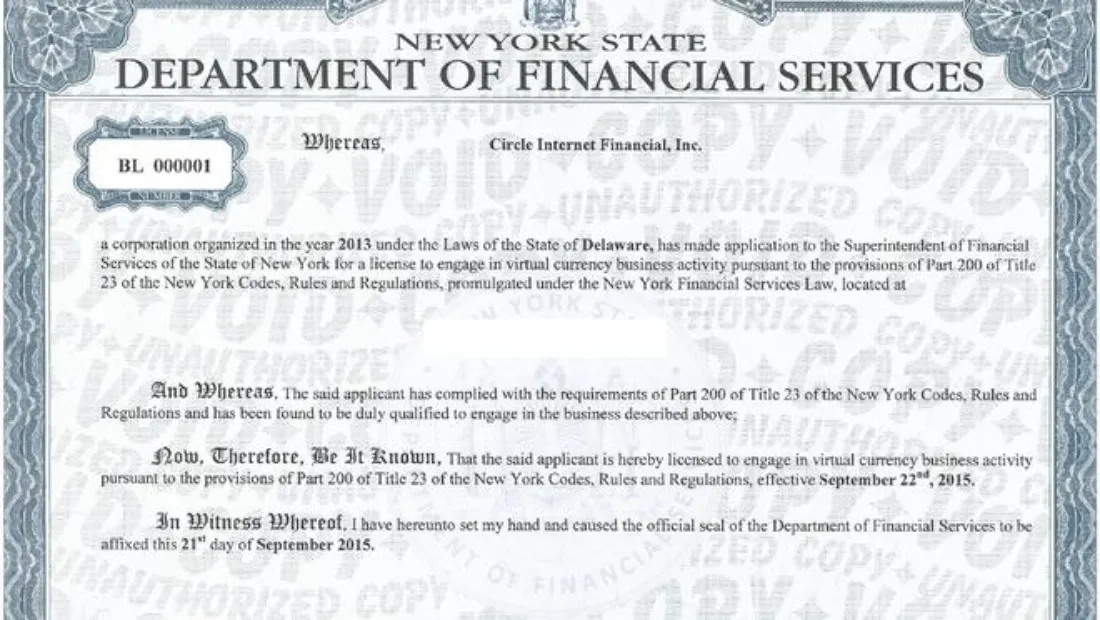

New York was a major hub of Bitcoin adoption in 2013, so hopes were high that the city’s attempt to regulate the industry would bring clarity and allow serious players to enter. The BitLicense emerged within days of Charlie Shrem's arrest as the city looked to clean up its act. Unfortunately, the legislation was a labyrinthine maze of legalese and onerous compliance demands that required an army of lawyers just to parse.

New York City is America’s financial hub and by 2013 it had become synonymous with the new digital finance frontier that was emerging, driven by Bitcoin. Many of its most prominent figures and companies originated there, and it even had its own Bitcoin Center in the heart of the financial district that hosted biweekly trading events in “Satoshi Square.” But New York wasn’t just home to companies operating on the frontlines of the global economy – it was also home to agencies tasked with regulating them.

On the one hand, NY was the global capital of traditional finance, a city whose very identity was intertwined with the institutions of Wall Street. On the other, it was a vibrant and chaotic hub for a burgeoning cypherpunk-driven technological movement that aimed to fundamentally disrupt that very financial system. This inherent tension defined the city's Bitcoin scene, creating an atmosphere of ideological conflict that would ultimately set the stage for one of the world's most consequential experiments in digital currency regulation.

While the New York State Department of Financial Services (NYDFS) had already launched its inquiry into virtual currencies in August 2013, the process was dramatically accelerated by a perfect storm of high-profile negative events in early 2014. The first blow came just two days before the NYDFS was scheduled to hold its landmark public hearings on virtual currency when New Yorker Charlie Shrem was arrested at John F. Kennedy International Airport and charged with money laundering.

One month later, Mt. Gox exchange, responsible for handling over 70% of all trading volume, abruptly ceased trading and filed for bankruptcy. There was a global vacuum when it came to regulating cryptocurrency, whose borderless and permissionless nature made it difficult to control. It was a breach that New York, with its robust financial regulatory framework, felt it was primely positioned to step into.

Licencing Bitcoin

The architect of the BitLicense was Benjamin M. Lawsky, the first Superintendent of the New York State Department of Financial Services. To get the ball rolling, a series of hearings were held in January 2014. While presented as an open-minded inquiry, these largely served to legitimise a regulatory agenda that was already taking shape.

When it came to digital currencies, Lawsky articulated a desire to strike a balance between fostering innovation and protecting the public. He stressed that the goal was not to “doom promising new technologies before they get out of the cradle” but to put in place “common sense rules of the road” to protect consumers and root out illicit activity. While the BitLicense that was ultimately passed did plenty of the latter, it effectively stifled innovation.

The first draft of the BitLicense, released in July 2014, was a dense and far-reaching document that sent shockwaves through the industry. Its core provisions were seen by many as not just burdensome, but fundamentally unworkable and antithetical to the nature of the technology it sought to regulate.

The proposal's scope was breathtakingly broad. It defined “Virtual Currency Business Activity” so expansively that it threatened to capture not only custodial exchanges and money transmitters, but also non-custodial software developers, wallet providers, and potentially even those who created new decentralized cryptocurrencies. This created immense uncertainty and fear that merely writing code could require a multi-million-dollar licensing process.

To compound matters, the proposal created a rigorous anti-money laundering regime in which even a tiny transaction deemed suspicious would trigger a reporting obligation, threatening to bury companies in paperwork. The backlash was instant and intense, with 3,000 public comments criticising the proposed regulation. Circle, for example, stated bluntly that compliance with the proposal as written would be technically impossible and would force the company to block all New York customers, pushing innovation and capital offshore.

Jerry Brito, Executive Director of crypto policy thinktank Coin Center, asserts that the BitLicense proposal was “far too broad and burdensome. It swept in small startups and even open-source developers who posed little consumer risk, while layering on duplicative requirements for firms already regulated at the federal level.”

He continues: “After strong public feedback, New York narrowed the scope, added exemptions for software developers and merchants, and aligned some requirements more closely with federal AML rules. Those changes made the framework more workable, though it still remained one of the most restrictive state regimes.”

Faced with this deluge of criticism, the NYDFS went back to the drawing board, eventually releasing a revised proposal in February 2015 and a final rule in June 2015. But the revised BitLicense was scarcely any lighter in its compliance obligations. Rather than flocking to New York to apply for the badge, a significant number of companies chose to flee the jurisdiction entirely.

To rub further salt into the wounds of U.S. businesses that had to deal with the complexities of the BitLicense, several of its architects later switched sides and found lucrative jobs lobbying for Bitcoin firms. These included head honcho Benjamin Lawsky, who ended up representing Bitcoin businesses, and Dana Syracuse who went from drafting the BitLicense to finding legal work in the Bitcoin industry.

The mass departure of Bitcoin businesses in 2015, dubbed the “Great Bitcoin Exodus,” would take years to undo. The U.S. had made its first serious attempt at regulating digital currency and it was widely regarded as a failure. The overzealous regulation drove a rift between Bitcoin and the lawmakers intent on controlling it.

- Artist

- BTC On this day

- January 28, 2014

- Market Cap

- $10,276,177,792

- Block Number

- 283,040

- Hash Rate

- 18,608.3 TH/s

- Price Change (1M)

11%

- Price Change (3M)

328%

- Price Change (1Y)

4354%