CHECKED OUT

May 1, 2011

1BTC:$3.033100

- Artist

- Valérie Biet

- Fact Date

- May 1, 2011

- Fact #

- 044

- Printing Specifications

- Paper / Stock

- Xper paper

- Page Size

- 70cm x 35cm

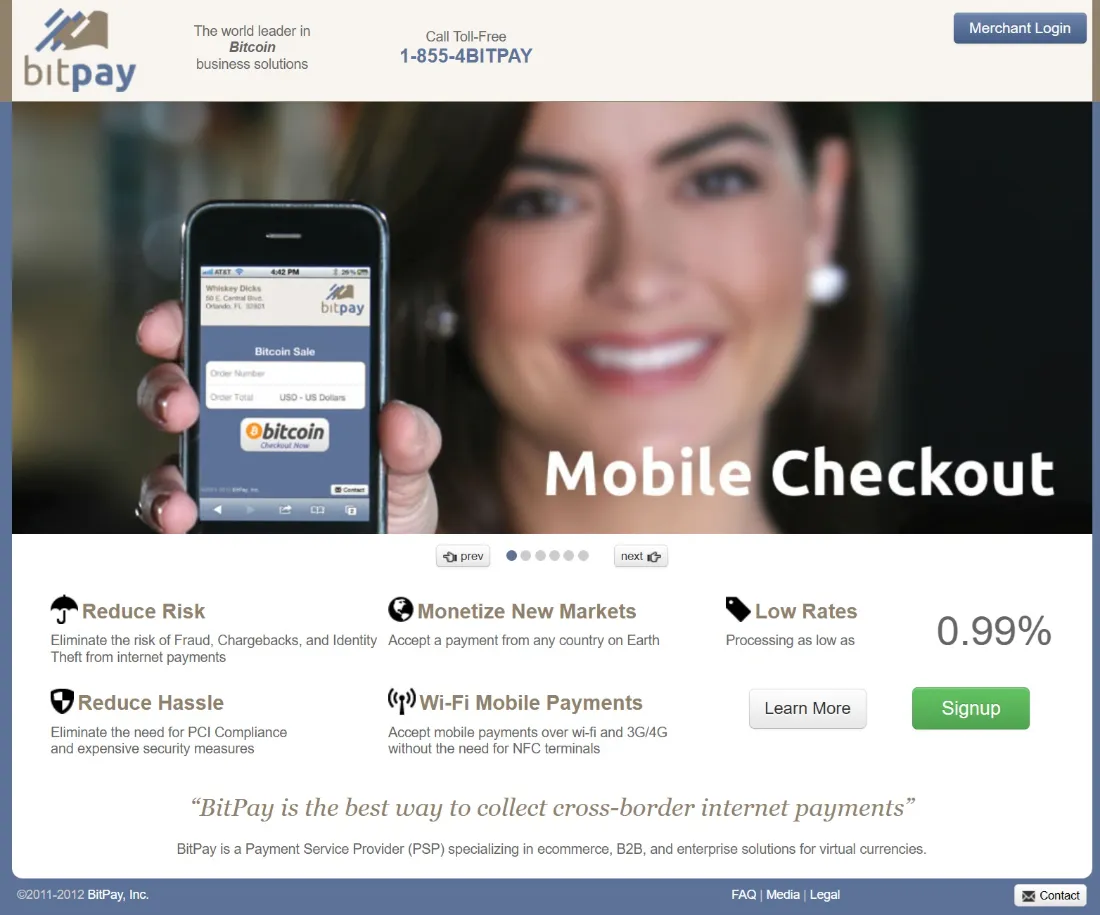

As 2011 ground into high gear, Bitcoin was beginning to be taken seriously but it was still hard to buy and sell with fiat currency. In May, it acquired its first ecommerce solution, allowing websites to accept BTC at checkout. BitPay made this milestone possible and it remains one of the leading Bitcoin payment solutions to this day.

By 2011, a handful of enterprising Bitcoiners had integrated BTC payments into their businesses. But the implementation was rudimentary to put it mildly: it typically involved the vendor sharing a wallet address that customers could send funds to. But with no means of correlating each payment with the ecommerce transaction in question, it was a solution that didn’t scale. There had to be a better way.

The first company to embrace this challenge was founded with that exact mission: to make accepting BTC as easy as supporting credit card or PayPal. Its name was BitPay, and as its name spelled out, it was in the Bitcoin payments business.

Recalling the journey that led to the company’s formation, BitPay co-founder Stephen Pair says: “I’ve always been fascinated by the history of financial systems and cryptography. Then I came across DigiCash, which was really the first cryptographic payment system, but it was centralized and ultimately failed. But it got me (and many others) thinking about whether it was possible to create a payment system for the internet that didn’t require a centralized company to operate it.

“When Bitcoin came along and I read the Satoshi whitepaper, it just clicked. Here was this massive breakthrough in computer science, but it was explained in such simple, straightforward language that anyone could grasp it. The idea of decentralized, cryptographic money felt revolutionary. We believed Bitcoin had long-term value, but more importantly, we wanted people to actually be able to use it, not just hold it as some speculative asset. That’s really what inspired BitPay. Building a way for both individuals and businesses to get real-world utility out of Bitcoin.”

BitPay didn’t waste time and by summer 2011 had released its first product: an online checkout system that online merchants could integrate to accept BTC. “In the beginning, it was really the mom-and-pop shops who were curious enough to give it a try,” notes Pair. “The bigger players were more skeptical. Bitcoin was brand new and untested. What helped was showing them that accepting BTC didn’t mean they had to deal with price swings or keep it on their balance sheet. We solved a real problem by letting them get paid in dollars while still tapping into this new customer base. Once those early adopters proved it worked, the bigger names started to come onboard and eventually companies like Microsoft and AT&T integrated BitPay.”

While the Bitcoin community had long understood the way a scalable payment system should work – including the creation of a unique deposit address for each transaction – implementing this was harder than it sounds, since there were other variables to take into account. Chief among these was Bitcoin’s volatility, which meant the risk of its price moving between the time of making the online purchase and completing checkout.

BitPay’s solution was a smart one, albeit not bulletproof. When a customer chose to pay in Bitcoin, BitPay would generate a unique payment invoice – displaying a Bitcoin address and QR code – and lock in the BTC price for about 15 minutes. It was good enough to get the ball rolling and make Bitcoin payments viable. And as BTC’s volatility started to diminish, the service would only improve.

Checking Out in Crypto

When BitPay launched its BTC payment solution, stablecoins didn’t exist, but the company devised a solution that would save merchants from being held hostage by the price of Bitcoin. BitPay would instantly convert incoming bitcoins to a chosen fiat currency such as USD or EUR and deposit the funds to the merchant’s bank account or Bitcoin wallet if they preferred to hold BTC. This meant a merchant could avoid price risk and receive the exact dollar amount for each sale by the next business day.

When BitPay launched its payment solution, crypto regulation was nonexistent, since most regulators had scarcely heard of Bitcoin, let alone worked out how to treat it. This didn’t mean that BitPay was immune from having to comply with regulations – it still intersected heavily with traditional finance after all. Nevertheless, the fact that customers would be paying via their own Bitcoin wallets meant merchants didn’t have to handle sensitive financial information, such as storing credit card details, which made life easier.

Unsurprisingly, BitPay’s launch was met with considerable excitement in the Bitcoin community. Up until now, real-world integrations – especially those intersecting with fiat off-ramps – had only been attempted in earnest by hobbyists and solo devs. This was the first time a proper company had thrown its weight behind Bitcoin and offered to develop core infrastructure. Bitcoin was now open for business.

The general consensus among existing Bitcoiners was that BitPay solved a critical usability gap, providing an all-in-one solution that automated invoices, payment verification, and currency conversion. That said, a few skeptics pointed out that BitPay introduced a third-party intermediary – a concept somewhat at odds with Bitcoin’s decentralized ethos. The counter to this was that BitPay was optional and simply made life easier for those merchants who didn’t want to handle Bitcoin’s complexities. The 0.99% fee levied was cheaper than credit card processing and was easily justified by the instant fiat conversion and fraud protection BitPay provided.

“One of the most memorable moments from the early days has to be the Bitcoin St. Petersburg Bowl back in 2014,” recalls Pair. “This was long before crypto logos were showing up on NBA jerseys or stadiums. We sponsored a college football game between NC State vs. UCF and even made the tickets available for purchase with BTC. The game aired on ESPN, reaching millions of viewers and putting Bitcoin in a completely new context. It was one of those moments where it became clear that Bitcoin was breaking into the mainstream, and it showed us how big BitPay could become.”

One of the earliest adopters was MemoryDealers, an online electronics and networking hardware store run by Bitcoin enthusiast Roger Ver. MemoryDealers began accepting BTC around June 2011 – which was understandable given that Ver was an angel investor in BitPay and eager to prove Bitcoin’s usefulness in commerce, making him one of the company’s first clients. He wouldn’t be the last.

- Artist

- BTC On this day

- May 1, 2011

- Market Cap

- $18,373,458

- Block Number

- 121,218

- Hash Rate

- 0.952 TH/s

- Price Change (1M)

291%

- Price Change (3M)

483%

- Price Change (1Y)

101003%