EXCHANGE TRADED FUN

January 11, 2024

1BTC:$46360.187760

- Artist

- Fraydikyt

- Fact Date

- January 11, 2024

- Fact #

- 124

- Printing Specifications

- Paper / Stock

- Tintoretto paper

- Page Size

- 70cm x 35cm

In January 2024, Bitcoin took another leap into mainstream finance with the launch of the first Bitcoin spot ETF. After years of anticipation and regulatory hurdles, the ETF approval marked a turning point for institutional adoption, providing investors a regulated way to gain exposure to Bitcoin without holding it directly. The milestone brought a surge of interest from traditional finance, opening the door for broader participation and solidifying Bitcoin’s role in global markets.

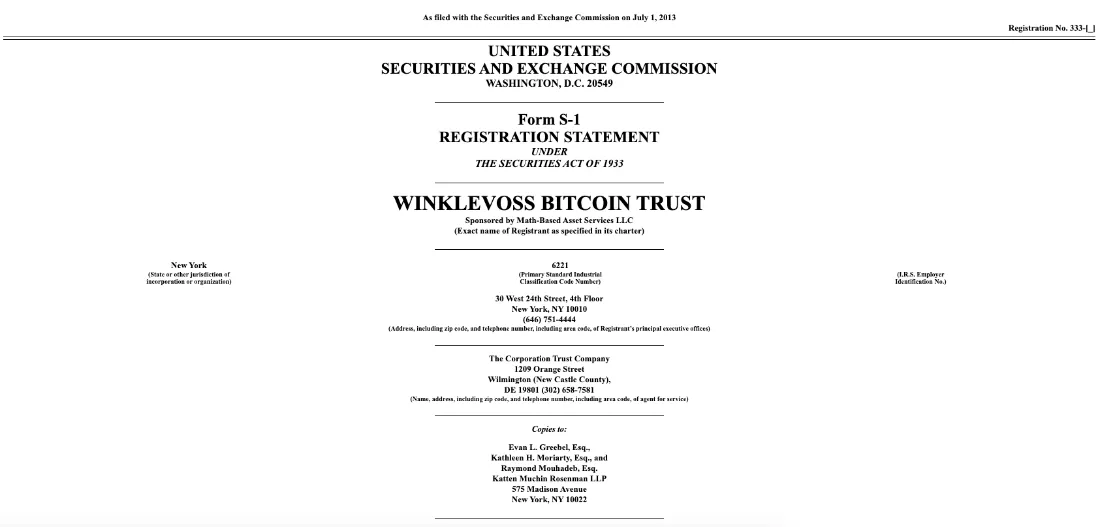

The Bitcoin ETF was a long time coming, with the idea having been floated – and even attempted – unsuccessfully for years. It was widely accepted that an ETF would be approved at some stage, but quite when was anyone’s guess. What was evident, however, was that its introduction would require a combination of the right proposal from a suitable institutional player coupled with the right regulatory environment for the SEC to ensure its passage.

As early as 2013, the Winklevoss twins filed for a Bitcoin ETF but the SEC flatly rejected their proposals. Both in 2017 and again in 2018 they were knocked back, with the agency reasoning that Bitcoin markets were not sufficiently mature and lacked robust surveillance to prevent fraud.

Between 2019-22, other players entered the fray including ProShares, VanEck, SkyBridge, Fidelity, and Bitwise, each endeavouring to convince SEC Chair Gary Gensler that the time was right for a Bitcoin ETF. On each occasion, however, the SEC refused, trotting out the same concerns about unregulated spot exchanges that were prone to manipulation. A frustrated Grayscale threatened to sue the SEC as the battle became ugly.

Despite this outbreak of hostilities, the first Bitcoin ETF was now closer than ever – even if it took an outsider to get it over the line.

Player 2 Enters the Game

In June 2023, BlackRock entered the fray. As the world’s largest asset manager, it was accustomed to getting its own way and having set its sights on a Bitcoin ETF, it wasn’t going to rest until it had it. With beefed-up market monitoring built in and the support of Coinbase and Nasdaq, BlackRock’s filing intensified the pressure on the SEC to cave in.

The beleaguered agency faced further pressure in August when a federal appeals court handed the blockchain industry a major victory, ruling that the SEC’s earlier rejection of Grayscale’s ETF proposal was “arbitrary and capricious.” Sensing which way the wind was blowing, the SEC capitulated.

Eric Balchunas, Senior ETF Analyst at Bloomberg, believes that the single biggest turning point in the approval process was Grayscale winning their lawsuit against the SEC. “It is hard to fight the law and win. And they did it. This forced a very resistant SEC's hand to approve the spot ETFs.”

Following 20 prior rejections, on January 10, 2024, the Commission voted to approve rule changes allowing the listing of spot Bitcoin ETFs on exchanges. In a bizarre twist the day before approval, an unauthorized post on the SEC’s official X (Twitter) account falsely claimed the Bitcoin spot ETFs had been approved, forcing the agency to quickly delete the hoax.

But the hoax was real as 11 spot Bitcoin ETFs from a range of issuers were approved at once including funds by BlackRock (iShares), Fidelity (Wise Origin), ARK Invest/21Shares, Invesco/Galaxy, VanEck, WisdomTree, Valkyrie, Bitwise, and the conversion of Grayscale’s Bitcoin Trust.

For the first 15 years of existence, Bitcoin had zero ETFs. Now it had almost a dozen. Whereas the approval of CME and CBOE’s Bitcoin futures products in 2017 sent the market into a downward spiral that it took years to recover from, the ETF approval had the opposite effect. Slowly but steadily, billions of dollars began to flow into the various Bitcoin ETFs, which by the end of Q1 had reached $12B.

The launch of the spot bitcoin ETFs kicked off a whole new era: the financialization of bitcoin,” reflects Eric Balchunas. “Having the ETFs put Bitcoin into the plumbing of traditional finance legitimized bitcoin which made advisors and average investors feel comfortable with getting exposure to it.

To the delight of the institutions that had worked so hard to get Bitcoin ETF approval, and to the relief of the SEC that had opposed it for so long, everything went smoothly. The first six months of 2024 were marked by rapid ETF growth, largely smooth performance tracking, and an infusion of institutional-grade liquidity that saw BTC’s price ascend by 40% to a high of $71K in April. After years of false dawns and broken promises, the institutions were finally here and they were in no hurry to leave.

According to CoinDesk’s James Van Straten, “The launch of the Bitcoin ETFs in January 2024 has become the most successful ETF debut in history…The current period for Bitcoin mirrors that of 2004–2005, when the launch of the Gold ETF marked the beginning of a seven-year bull run in gold prices.”

- Artist

- BTC On this day

- January 11, 2024

- Market Cap

- $908,461,200,503

- Block Number

- 679,392

- Hash Rate

- 598,989,400.356 TH/s

- Price Change (1M)

11%

- Price Change (3M)

72%

- Price Change (1Y)

158%