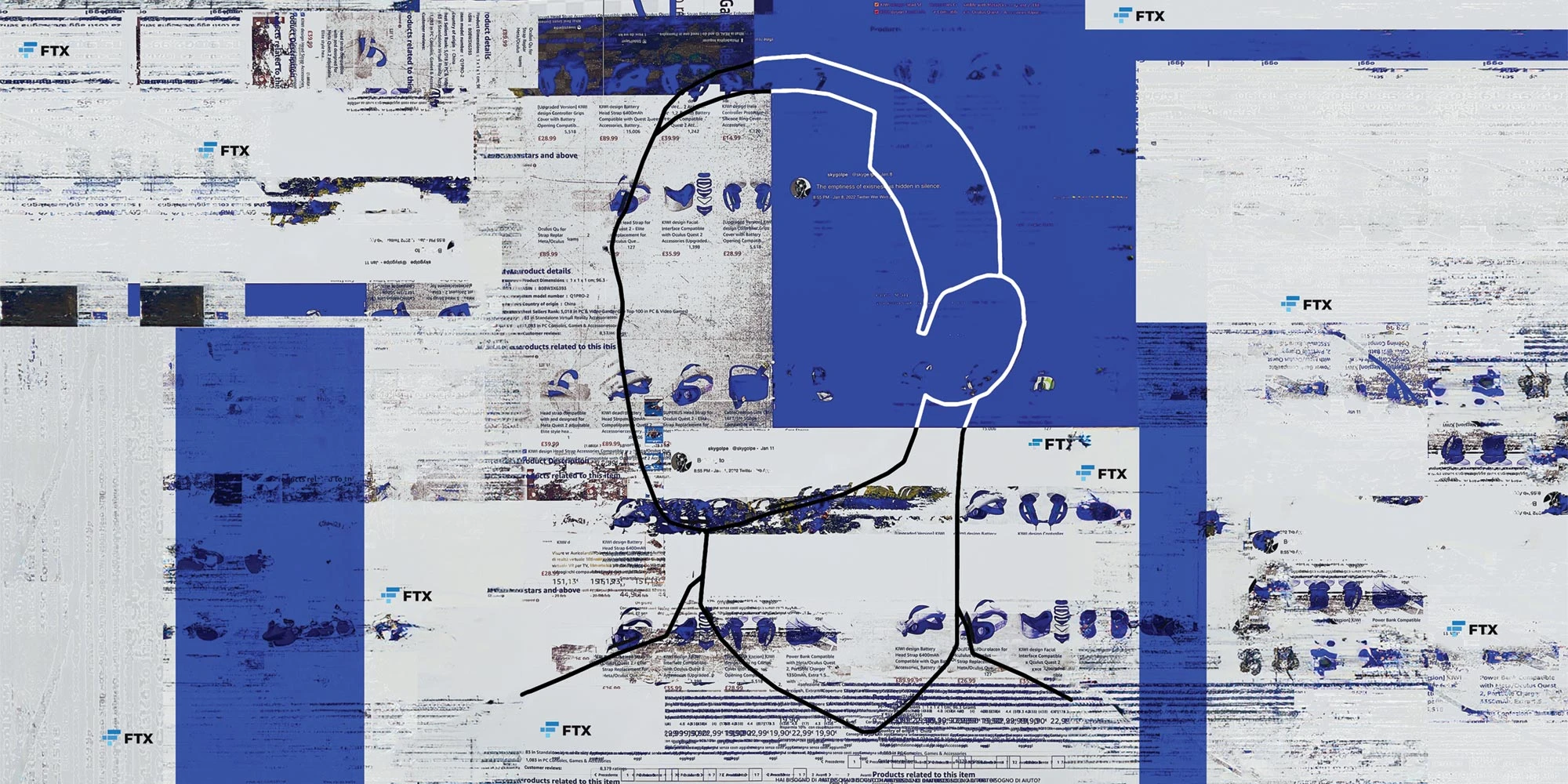

FALSE GODS

November 11, 2022

1BTC:$17003.320250

- Artist

- Skygolpe

- Fact Date

- November 11, 2022

- Fact #

- 122

- Printing Specifications

- Paper / Stock

- Tintoretto paper

- Page Size

- 70cm x 35cm

The collapse of FTX in 2022, following egregious fraud by CEO Sam Bankman-Fried, exposed the risks of centralised platforms. This event, alongside the earlier failure of Do Kwon’s Terra blockchain, caused billions in losses and highlighted the fragility of centralised blockchain services. It was a wake up call to return to the core properties that Bitcoin was built on – transparency and decentralisation.

Every Bitcoin generation has its Mt. Gox moment, a collapse so spectacular that the fallout lasts for years, depressing the market and leaving cryptocurrency holders counting the cost. For the class of 2022, that moment arrived with the failure of FTX. It was as spectacular as it was messy – and it took almost everyone by surprise.

While in hindsight there were signs that things at FTX were not as they seemed, few appreciated the hubris and risk-taking embedded in Sam Bankman-Fried’s stewardship of the cryptocurrency exchange. As the public face and undisputed leader of the FTX empire, the blame for the flagrant financial mismanagement that unfolded falls squarely on SBF’s shoulders.

It wasn’t just the way in which FTX collapsed, transforming traders into anxious creditors, that rankled, but the hypocrisy that came bundled with SBF’s “effective altruism” shtick. His personal philosophy was meant to be about pursuing social good over profit – but somewhere along the way he got his priorities mixed up. The results were to prove catastrophic for SBF and his customers alike.

His status as the second-largest individual donor to Joe Biden's 2020 presidential campaign had further cemented his image as a serious figure. This cultivated persona created a powerful halo effect, a form of social engineering that lowered the defences of the very institutions that should have been performing due diligence on the cheques they were writing for his ever-expanding empire.

The Making of a Meltdown

The meltdown of FTX was the result of its multi-layered architecture resting on three shaky pillars: a conflicted corporate structure that erased the lines between entities; a financial illusion built upon a self-created token; and technical manipulation embedded directly into the exchange's source code. Together, these elements created a system designed from its inception to siphon customer assets for personal enrichment and high-risk speculation.

The foundational flaw of the entire enterprise was the hopelessly conflicted relationship between FTX, the exchange, and Alameda Research, the proprietary trading firm. Both were founded and controlled by Sam Bankman-Fried, who owned approximately 90% of Alameda. In any regulated traditional financial market, such a relationship would be strictly prohibited due to insurmountable conflicts of interest. But FTX wasn’t inclined to do things by the book.

The central vulnerability of SBF’s business was exposed on November 2, 2022, when CoinDesk revealed that a vast portion of Alameda's assets – the supposed collateral backing its massive trading operations – consisted of billions of dollars of FTT. They were using the exchange’s native token, in other words, which had been created out of thin air, and whose price performance was directly correlated to public confidence in the exchange. Should that evaporate, so would the demand for FTT.

Over ten days that November, a series of revelations and desperate manoeuvers brought FTX’s $32 billion empire to its knees. The collapse was a textbook bank run, supercharged by the unique dynamics of the cryptocurrency market: real-time onchain transparency and the outsized influence of social media. YouTuber Ben “BitBoy” Armstrong flew to the Bahamas to “hunt down” SBF, even locating his Toyota Corolla and knocking on the door.

Meanwhile, one-time ally and now bitter rival Changpeng “CZ” Zhao poured kerosene on the flames when he announced that Binance would liquidate its entire FTT holdings valued at around $529 million. The end was nigh.

SBF did his best to quell the rising panic, dispatching hopium-fuelled tweets asserting that “FTX is fine. Assets are fine.” They weren’t fine. The value of the FTT token collapsed by over 80% in a single day, erasing billions in paper wealth and rendering Alameda's balance sheet worthless.

It was high drama for those unaffected by the fallout. But nervy stuff for those with their assets trapped in FTX. Particularly once Binance’s briefly tabled buyout was withdrawn once they took a look at the books. If they couldn’t save FTX, no one could. On November 11, FTX filed for bankruptcy as regulators circled.

Further filings would follow as prominent figures tied to FTX saw reputational fallout, leading to celebrity endorsers like Larry David, Tom Brady, and Steph Curry being named in investor lawsuits and lampooned in memes for vouching for what turned out to be a house of cards.

As for SBF, the industry’s golden boy had lost his halo – and would subsequently lose a lot more than that. But the real victims were the millions of FTX users subjected to their very own Gox moment. It was a lesson they would never forget.

- Artist

- BTC On this day

- November 11, 2022

- Market Cap

- $326,536,650,574

- Hash Rate

- 242,428,226.8 TH/s

- Price Change (1M)

11%

- Price Change (3M)

30%

- Price Change (1Y)

73%