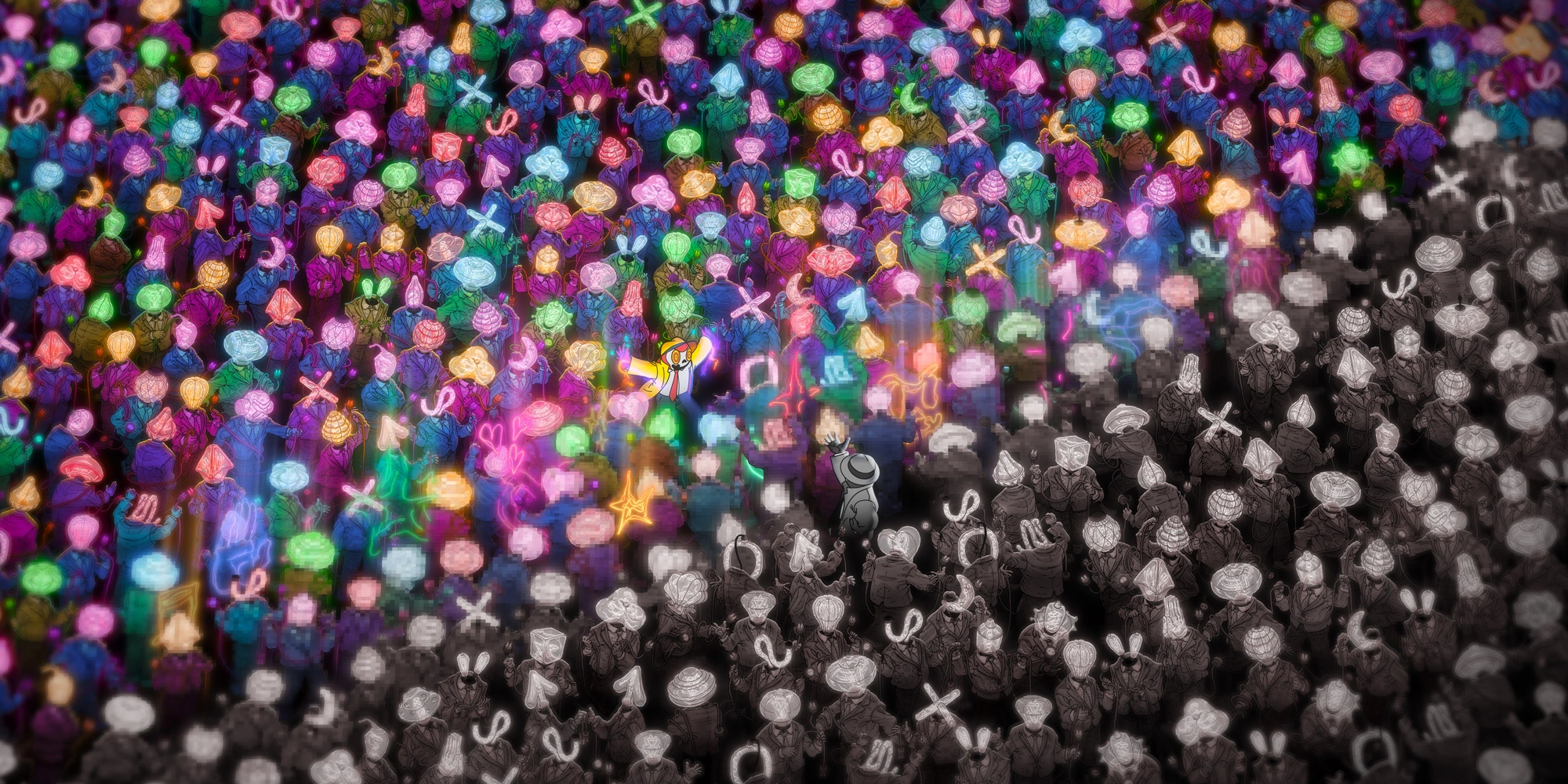

FIFTY ONE PERCENT

June 12, 2014

1BTC:$581.803300

- Artist

- Mr Misang

- Fact Date

- June 12, 2014

- Fact #

- 085

- Printing Specifications

- Paper / Stock

- Tintoretto paper

- Page Size

- 70cm x 35cm

No entity should ever command 51% of the Bitcoin hashrate, since doing so theoretically enables them to reorder transactions. Despite this objective, it’s happened on multiple occasions, most famously when the Ghash mining pool dominated network hashrate in 2014. Thankfully, it did no evil and miners worked quickly to reallocate their hash power. To this day, Bitcoin has never suffered a 51% attack by a malevolent mining pool.

Like all networks, Bitcoin grows stronger as its users increase. This is particularly true of mining, the process by which new bitcoins are minted, transactions validated, and the network secured. A core principle of the protocol’s design, often referred to as Nakamoto Consensus, is that the longest valid chain – the one with the most cumulative PoW – is accepted by all network participants. This means that even if a rogue miner attempts to include false transactions, the rest of the network will reject them.

However, this design contains a theoretical vulnerability that has been understood since Bitcoin’s inception: the 51% attack. Should a single entity or colluding group manage to control a majority of the network's total computational power – hashrate – they could theoretically undermine the integrity of the blockchain. By possessing superior hashing power, this entity could secretly build an alternative version of the blockchain faster than the rest of the “honest” network.

This capability would enable the attacker to reverse their own recent transactions, leading to double-spending, and to censor the transactions of other users. At best, this would cause mass confusion over which version of the chain was correct. At worst, it could split the Bitcoin network and permanently impair trust in the inviolability of its transaction history.

For years, this threat was considered a low probability for a network as large and distributed as Bitcoin, with the immense cost of acquiring such hashrate deemed prohibitively expensive. The events of 2014, however, would prove this assumption dangerously optimistic.

Ghash Gains a Foothold

All through 2013 and 2014, Ghash.io’s mining dominance had been growing. Its 0% pool fee attracted miners in their droves. They were also taken by its merged mining feature, allowing members to simultaneously mine for Bitcoin and other Scrypt-based altcoins like Litecoin and Dogecoin using the same hashrate. Gash’s explosive growth was further aided by its deep integration with parent company CEX.io, a London-based cryptocurrency exchange that pioneered the concept of cloud mining and the trading of hashrate as a commodity.

Ghash’s rise to command over 50% of the network’s hashrate didn’t come out of the blue. In January 2014, it had exceeded 45%, prompting urgent calls for miners to diversify their hashrate to smaller pools to mitigate the centralising threat. Ghash, to its credit, promised to “take all necessary precautions to prevent reaching 51%” and announced that they would temporarily suspend the acceptance of new independent mining facilities into the pool. However, the company had a history of broken promises, and the community’s fears were not assuaged.

They were right to be concerned, for on June 3, 2014 this nightmare scenario came to pass as the pool’s hashrate surpassed 51%. The confirmation that a single entity controlled a majority of Bitcoin's hashrate triggered an immediate community response, the most dramatic coming from Bitcoin core developer Peter Todd, who announced that he was selling 50% of his bitcoin holdings.

Cornell professors Emin Gün Sirer and Ittay Eyal, whose academic work on selfish mining had now become a reality, were among the most vocal critics. Sirer described the situation as “Armageddon,” arguing that Bitcoin's core value proposition of decentralised trust had collapsed. They contended that the community could no longer rely on the goodwill of Ghash.io and called for an urgent hard fork to implement technical fixes that would disincentivise the formation of large pools.

Gavin Andresen adopted a more measured stance. While he acknowledged the seriousness of mining centralisation, he sought to quell the rising panic by stating that a 51% attack was “pretty easy to defend against” through software updates that could allow nodes to ignore the attacker's blocks.

While developers debated technical solutions, the broader Bitcoin community mobilised a powerful, non-technical defence by urging individual miners to act in the collective interest by pointing their hashrate to alternative pools. In the end, however, the crisis was de-escalated by mining operation BitFury, which announced that it was withdrawing its hashing power from Ghash. This move did the trick, moving the pool’s total hashrate back from the 51% brink.

Although there was no real incentive for Ghash to abuse its dominance, the 51% event served as a wake-up call to the mining community. Never again must a single pool be allowed to control the network’s hashrate.

- Artist

- BTC On this day

- June 12, 2014

- Market Cap

- $7,496,811,877

- Block Number

- 305,652

- Hash Rate

- 95,733.517 TH/s

- Price Change (1M)

33%

- Price Change (3M)

7%

- Price Change (1Y)

434%