IT BEGAN WITH A CRASH

June 7, 2007

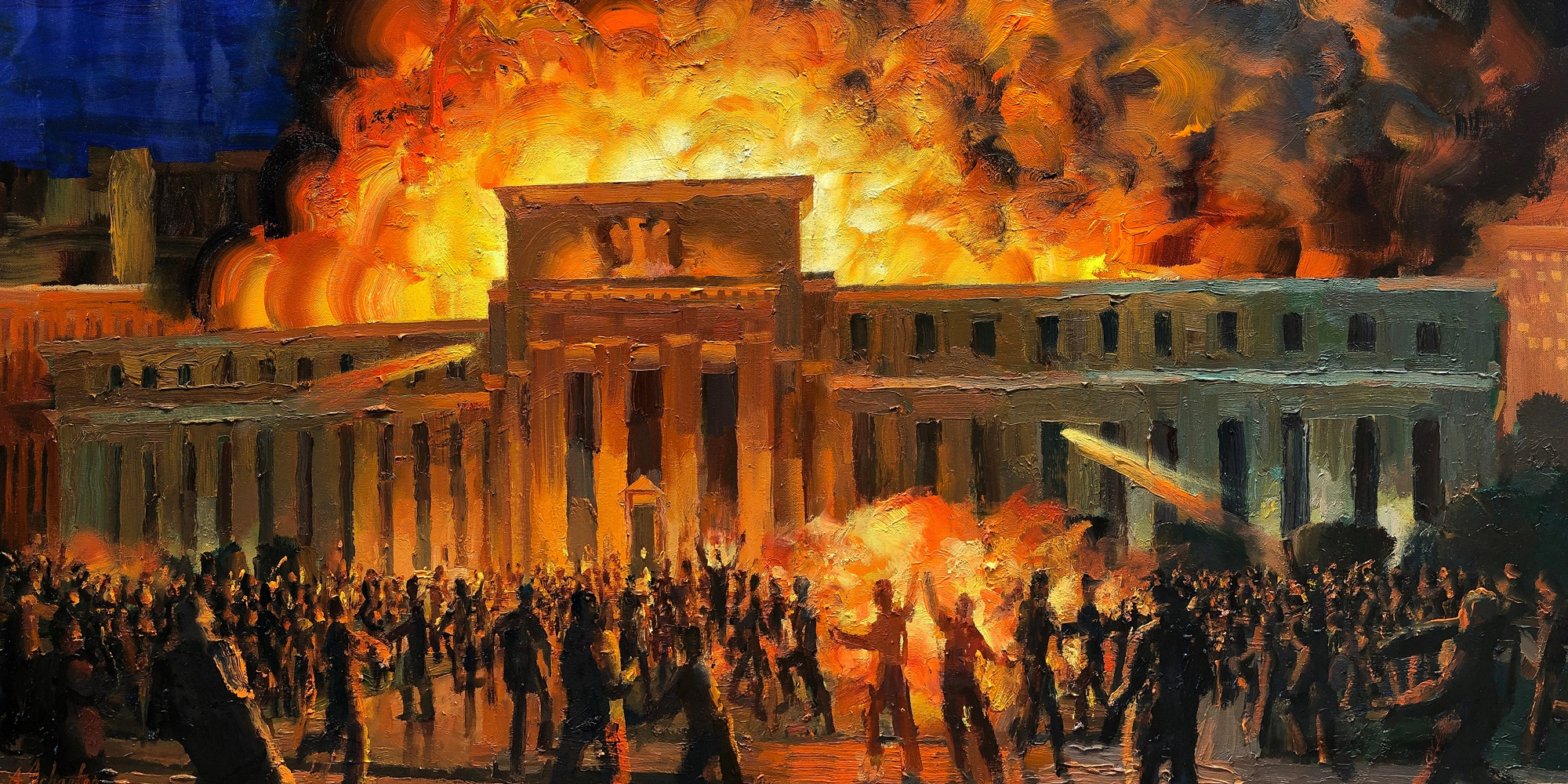

- Artist

- Alex Schaefer

- Fact Date

- June 7, 2007

- Fact #

- 010

- Printing Specifications

- Paper / Stock

- Tintoretto paper

- Page Size

- 70cm x 35cm

While Satoshi was crafting the Bitcoin codebase in 2008, a financial crisis was unfolding. Reckless lending by US banks triggered a housing crash that took out Lehman Brothers, sparked a global recession, and exacerbated widespread mistrust of financial institutions. When the banks got bailed out, the public were outraged.

Bitcoin began with a crash. At the same time that Satoshi was assembling his ideas for a fixed-supply digital currency, the financial world was in meltdown. One of the worst economic crises since the Great Depression was underway, triggered by the usual human flaws that had a tendency to ruin good things: greed coupled with opaque financial mismanagement.

It’s easy to imagine Satoshi hunched at his terminal, playing around with Merkle trees, while the faint glow of a television in a corner of the room broadcasted pictures of shocked Lehman Brothers staff carrying their possessions away in cardboard boxes. Before the crash, Bitcoin was a nice idea. Now it was a necessity.

Long before Wall Street traders got their jotters, cracks in the subprime lending landscape had begun to emerge. In February 2007, New Century Financial – then the #2 subprime mortgage lender – announced major defaults and pending losses. The next day, HSBC revealed a $10.5 billion write-down due to U.S. subprime loan losses. Something was wrong, but no one was heeding the warning. A second canary in the coal mine surfaced in June when Bear Stearns suspended investor redemptions in two of its flagship hedge funds – funds that had heavily leveraged exposure to subprime mortgage securities.

The dominos started rapidly toppling from there, culminating in the collapse of Bear Stearns in 2008 followed by Lehman Brothers in September, ending its 158-year history. If the beginnings of the financial crisis had strengthened Satoshi’s resolve to develop an alternative financial system, its climactic act provided all the impetus he needed to get it over the line.

Born in a Bear Market

By late September 2008, the markets were in full-blown panic. Credit markets froze, banks hoarded cash, and stock markets plunged. In response, U.S. Treasury Secretary Henry Paulson proposed a $700 billion bank rescue fund to purchase toxic assets from banks. It’s easy to imagine Satoshi feeling a little schadenfreude as he finished the first draft of his whitepaper, whose concluding paragraph began: “We have proposed a system for electronic transactions without relying on trust.”

Satoshi had started working on his concept “a year and a half” before late 2008, placing it around May 2007 when Bear Stearns halted withdrawals and the term “bank run” re-entered common parlance. Observing these tremors, it seems Satoshi recognised the need for a monetary system that wasn’t dependent on a bank’s solvency or honesty.

As Chris Burniske notes, “The entwinement of the financial collapse on the one hand and the rise of Bitcoin on the other is hard to ignore. The financial crisis cost the global economy trillions of dollars and burned bridges of trust between financial titans and the public. Meanwhile, Bitcoin provided a system of decentralized trust for value transfer, relying not on the ethics of humankind but on the cold calculation of computers.”

On August 22nd 2008, Satoshi reached out privately to cryptographer Wei Dai – creator of an earlier digital money concept “b-money” – to cite his ideas. His email arrived as global markets were deteriorating: Fannie Mae and Freddie Mac would be rescued by the U.S. government on September 7th and Lehman was only weeks from bankruptcy. Satoshi was urgently putting the final pieces together just as the traditional system was in freefall. By late summer 2008, Bitcoin’s creator realised the time was ripe to introduce a radically different financial system.

- Artist

- BTC On this day

- June 7, 2007

- Circulating Supply

- 0

- Market Cap

- $0

- Number of Addresses

- 0

- Block Number

- 0

- Block Size

- 0

- Hash Rate

- undefined TH/s