MAKING A MARKET

March 17, 2010

1BTC:$0.005472

- Artist

- Other World

- Fact Date

- March 17, 2010

- Fact #

- 024

- Printing Specifications

- Paper / Stock

- Tintoretto paper

- Page Size

- 70cm x 35cm

Three months after NewLibertyStandard created an informal Bitcoin exchange, a new platform was developed that more closely resembled a conventional exchange. When Bitcoin Market went live in March 2010, you could buy 333 BTC for a dollar, but with greater liquidity came rapid price discovery. Bitcoin was about to take off.

New Liberty Standard holds the accolade of being the first Bitcoin exchange, but it wasn’t an exchange in the traditional sense: it was more of a trust-based OTC platform. The site that made Bitcoin truly tradable was bitcoinmarket.com – yet its creation wasn’t universally welcomed. NewLibertyStandard, for one, had issues with it – which is understandable given that Bitcoin Market was a direct competitor.

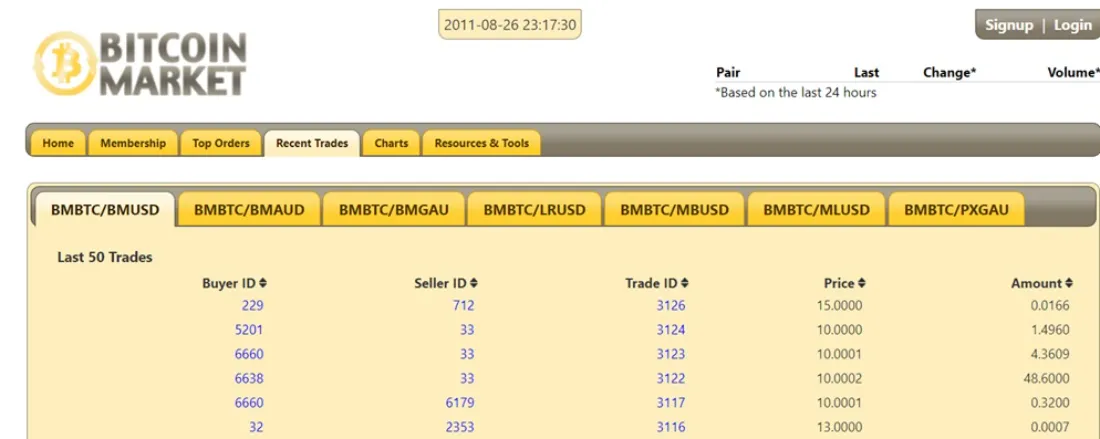

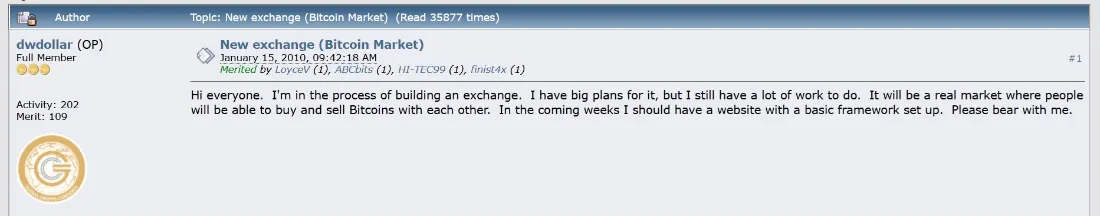

The site was first announced by forum user “dwdollar” on January 15th, 2010, promising: “It will be a real market where people will be able to buy and sell Bitcoins with each other.” He later added: “People will be able to trade Bitcoins for dollars and speculate on the value. In theory, this will establish a real-time exchange rate so we will all have a clue what the current value of a Bitcoin is, compared to a dollar.” It was evidence that Bitcoin was moving from being a decentralised currency to a financial commodity. In the process, the typical demographic drawn to it was shifting from techies to traders.

An Exchange Is Born

On March 17th, 2010, the first trade was completed on Bitcoin Market, in which 333 BTC was swapped for $1, and the exchange was up and running. At that point, just nine users had signed up to the first order book BTC exchange. Not surprisingly, Bitcoin Market was highly illiquid to begin with; a $50 buy could 2x the price. By summer 2010, however, the exchange was doing around $300 of weekly volume – a drop in the ocean by modern standards, but back then Bitcoin Market was the ocean, having rapidly overtaken New Liberty Standard.

Like New Liberty Standard, Bitcoin Market’s fiat onramp came courtesy of PayPal primarily, which worked for as long as PayPal neither knew nor cared what Bitcoin was. But by 2011, the world was starting to hear about Bitcoin, and money transmitters especially didn’t like what they heard. The Bitcoin network doesn’t support chargebacks but fiat rails do and a spate of chargeback frauds is believed to have signalled the death knell for Bitcoin Market when PayPal shut it off.

By that time, the writing was already on the wall for Bitcoin Market, which had been largely supplanted by another exchange that had launched in July 2010 – Mt. Gox. Nevertheless, for a short time, Bitcoin Market played a significant role in helping to grow awareness of Bitcoin. Its price ticker became the standard for measuring the value of bitcoin on any given day – even if that price fluctuated wildly due to the low liquidity and the ability for macro events to impact market confidence.

It’s no coincidence that during its tenure, Bitcoin Market oversaw a major uptick in the price of bitcoin. The cryptocurrency was trading at $0.003 when the exchange went live. Within six weeks, that had risen to $0.02 – almost a 7x increase. Bitcoin would likely have made it even without Bitcoin Market launching when it did. But in the event, it formed a useful bridge between the rudimentary New Liberty Standard and the more formal order book model that came next. It was the beginning of a new era for Bitcoin – one defined by speculation.

- Artist

- BTC On this day

- March 17, 2010

- Circulating Supply

- 2,600,000

- Market Cap

- $12,501

- Number of Addresses

- 569

- Block Number

- 68,000

- Block Size

- 70,000

- Hash Rate

- undefined TH/s

- Price Change (1M)

31%

- Price Change (3M)

792%