MARGIN CALL

October 22, 2012

1BTC:$11.710100

- Artist

- illtopia

- Fact Date

- October 22, 2012

- Fact #

- 061

- Printing Specifications

- Paper / Stock

- Matt coat paper

- Print Finishes

- Goss laminated

- Page Size

- 70cm x 35cm

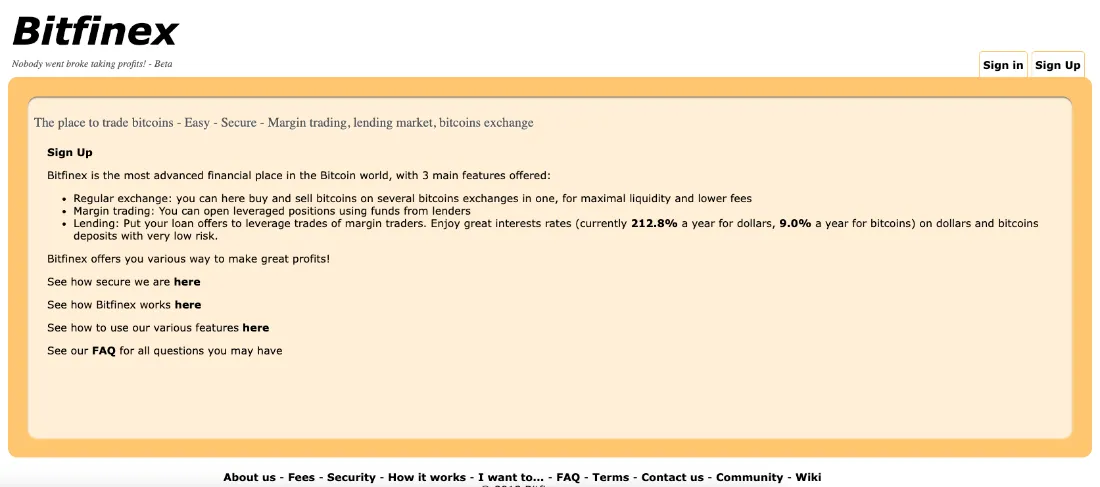

Evidence of Bitcoin’s maturation as an asset arrived in late 2012 when Bitfinex launched. Unlike existing spot exchanges, Bitfinex offered BTC lending and leveraged trading. The platform attracted professional traders and paved the way for high leverage exchanges such as BitMEX that would turn Bitcoin into a traders’ paradise.

The introduction of leveraged trading is regarded as evidence of an asset’s maturation since it allows traders to enter long or short positions. This bi-directional component was absent from Bitcoin initially, before being introduced by the short-lived Bitcoinica exchange, which offered margin trading but collapsed in mid-2012, leaving a gap in the market. Later that year, Bitfinex emerged and stepped into the breach.

In October 2012, Bitfinex went live with peer-to-peer lending for margin trading, marking the public debut of its lending and leverage products. The exchange was much more professional than anything that had gone before and began gaining serious traction in 2013 as the Bitcoin market heated up. As one reviewer at the time ventured, “Perhaps Bitfinex will indeed do what Bitcoinica… could not and provide a secure and lasting margin trading service for the masses.”

Bitfinex was the first Bitcoin exchange to integrate a peer-to-peer lending market for margin funding. This meant that users could lend out their BTC or USD to other traders and earn interest, with the loans being used to finance leveraged trades. Because demand for Bitcoin was so strong, by April 2013 Bitfinex lenders were earning annualized rates above 200% for USD, reflecting the huge demand from margin traders.

Bitcoin on Leverage

Like so many of the early Bitcoin companies, Bitfinex emerged from the Bitcointalk forum, having been founded by user “unclescrooge” (Raphael Nicolle). But unlike most of the projects whose origins can be traced back to the forum, Bitfinex was highly professional, not least in terms of the number of innovations it pioneered.

In addition to margin trading, Bitfinex was the first “meta-exchange” that aggregated order books from other major exchanges such as Mt. Gox and Bitstamp to deliver deep liquidity. It was also designed to be more secure than the exchanges that had gone before, with Bitfinex eschewing the hot wallet design that had proved the undoing of Bitcoinica. This approach was novel at the time, as most exchanges including Mt. Gox kept significant funds in hot wallets for instant withdrawals.

Other features that Bitfinex helped mainstream were limit and stop orders as well as more advanced charting tools. Not surprisingly, the exchange rapidly became the preferred venue for the professional traders that were now starting to take an interest in Bitcoin. In addition to day-traders, Bitfinex also onboarded more passive yield-seekers.

The margin funding feature created a role for more risk-averse users to participate in the Bitcoin economy by lending their dollars or bitcoins to earn interest. This in turn increased the liquidity of fiat on exchanges since people had a reason to hold USD on Bitfinex for lending, beyond just waiting to buy BTC.

Bitfinex provided the blueprint for the high-leverage exchanges that followed in its wake. While the exchange was not without its flaws, and would not prove immune to hacks, at the time it made significant progress in professionalising Bitcoin and making it more attractive to pro traders. It was, to all intents and purposes, the first attempt at creating an institutional-grade exchange long before institutions came calling.

- Artist

- BTC On this day

- October 22, 2012

- Market Cap

- $119,695,958

- Block Number

- 204,431

- Hash Rate

- 22.88 TH/s

- Price Change (1M)

4%

- Price Change (3M)

36%

- Price Change (1Y)

269%