MONEY PRINTERS

January 27, 2011

1BTC:$0.421200

- Artist

- Rare Scrilla

- Fact Date

- January 27, 2011

- Fact #

- 040

- Printing Specifications

- Paper / Stock

- Xper Paper

- Page Size

- 70cm x 35cm

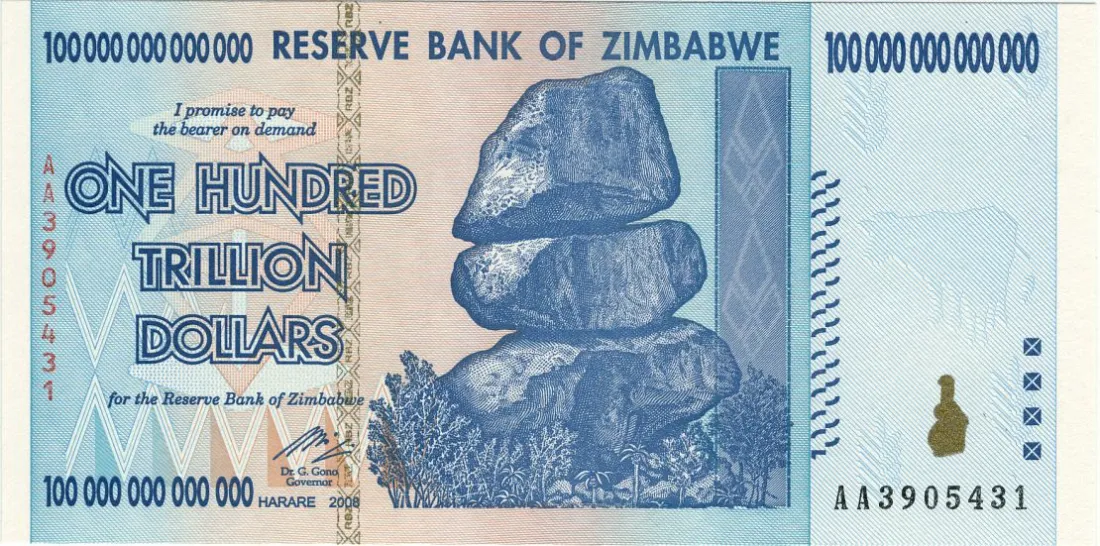

On the same day that Silk Road was receiving its first users, bitcoiners were receiving a lesson in hyperinflation. Three one-hundred trillion dollar bills from Zimbabwe were traded on the #bitcoin-otc IRC for 4 BTC each. The notes were worthless but the bitcoins, part of a fixed 21 million supply, proved precious indeed.

The #bitcoin-otc channel on IRC did exactly what it sounds like, facilitating private trades between individuals looking to buy and sell BTC. It was another way for bitcoiners to cash out at a time when fiat onramps were virtually nonexistent. On January 27th, 2011, an extraordinary currency swap took place in the OTC channel, both for Bitcoin and for the fiat currency involved.

On the #bitcoin-otc IRC, three Zimbabwean $100 trillion banknotes were exchanged for bitcoin at a rate of 4 BTC per note. Much more than just another OTC deal, it was a lesson in hyperinflation that contrasted the debased currencies of the past with the digital currency of the future: Bitcoin with its rigidly fixed supply.

In early 2011, the western world was still recovering from the 2008 financial crisis that’s credited with inspiring Bitcoin’s creation. At the same time, developing countries had financial problems of their own to grapple with, as was starkly seen in the case of Zimbabwe. In the late 2000s, Zimbabwe’s dollar had collapsed, reaching an estimated 79.6 billion percent inflation by 2008.

After 2009, the Zimbabwean dollar ceased to be legal tender, but the worthless bills found a nominal value as collector’s items and cautionary symbols of monetary collapse. In 2011, these notes could be bought for only a few US dollars each, yet they carried powerful symbolic weight: each note proclaimed “100 trillion dollars” on its face, a dramatic reminder of hyperinflation.

As Joe Bryan explains, hyperinflation means that “As new money floods in, input costs rise for every business, and every entrepreneur must raise prices simply to reinstate the profit margins they had before. This new money drives asset inflation, forcing savers into speculation and widening inequality. Families struggle to live the same lives as their parents, forced now to choose between a home and children, and a wave of mental strife envelops the population, eroding confidence in – and their commitment to – a better future.”

What better way to illustrate the gulf between Bitcoin and Zimbabwe’s devalued fiat currency than by exchanging four of the former for 300 trillion of the latter?

A Symbolic Deal

User “ptmhd” possessed several $100 trillion Zimbabwe banknotes and came up with the idea of trading them for Bitcoin. The going price was set at 4 BTC per note – around $3.20 in US dollar terms. On January 27th, 2011, three separate traders took the bait and bought a $100 trillion banknote for 4 BTC.

Of the pseudonymous users who each acquired a note, the third buyer stands out. This was “ribuck,” who is significant in being involved with the first BTC mobile transaction a month earlier. Ribuck was clearly keen to experiment with Bitcoin and to expand the possibilities of what could be done with it. The bitcoin transfers from the three buyers were confirmed onchain within approximately 10 minutes, but the physical banknotes took significantly longer to reach their destinations – around one week.

Although the #bitcoin-otc channel had an escrow system, the first two buyers didn’t bother with it, sending the coins straight to “ptmhd.” It’s further evidence of the innate trust that existed between community members in Bitcoin’s early days. Admittedly, the sums involved were low in US dollar terms at the time, albeit high in both Zimbabwean dollar and present-day Bitcoin terms.

For early Bitcoiners, many of whom were versed in Austrian economics or at least sympathetic to hard-money concepts, the trade was almost like a ritual exchange – trading the ultimate paper hyperinflation casualty for a piece of digital gold. It demonstrated their confidence that Bitcoin offered a better store of value.

- Artist

- BTC On this day

- January 27, 2011

- Market Cap

- $2,208,794

- Block Number

- 104,855

- Hash Rate

- 0.163 TH/s

- Price Change (1M)

49%

- Price Change (3M)

121%

- Price Change (1Y)

13124%