NOT YOUR KEYS NOT YOUR COINS

January 3, 2019

1BTC:$3832.155000

- Artist

- DADA

- Fact Date

- January 3, 2019

- Fact #

- 110

- Printing Specifications

- Paper / Stock

- Xper paper

- Page Size

- 70cm x 35cm

The tenth anniversary of the genesis block was leveraged by the Bitcoin community to emphasise the importance of self-custody. “Not your keys, not your coins” was the mantra underpinning Proof of Keys day, led by Trace Mayer. At a time of frequent exchange hacks, the campaign invited bitcoiners to put their trust in cryptography and return to the safety of self-custody.

The term “self-custody” postdates the creation of Bitcoin, since all custody was user-controlled initially, and thus it was a given that you owned the keys to your coins. There were no centralised exchanges or custodial wallets that could hold your bitcoins. But as Bitcoin went mainstream, and platforms emerged to facilitate onboarding and trading, users arrived in their droves, most of whom were less tech-savvy than the early adopters. In many respects, Bitcoin’s adoption cycle closely mirrored that of the internet.

The users who got into Bitcoin from 2012 onwards encountered exchanges springing up and centralised services ranging from LocalBitcoins to Mt. Gox offering to custody BTC on their behalf. This was useful in allowing quick access to BTC for trading purposes, but it also exacerbated a risk that wasn’t originally envisaged by Satoshi Nakamoto. He’d been trying to create a form of peer-to-peer digital cash that wasn’t reliant on third parties. But now bitcoiners were willingly embracing such third parties – despite a series of high-profile incidents that highlighted the inherent dangers.

Most holders knew the risks they were taking but figured that the benefits offered by centralised platforms outweighed the trade-offs. Even OG bitcoiners weren’t immune from forsaking the financial freedom of self-custody for a little convenience: many who should have known better kept their coins on Mt. Gox, only to later rue their foolhardiness.

According to NVK, co-founder of cold storage developer CoinKite, “Holding bitcoin gives you two key benefits: protection against debasement and personal sovereignty. But sovereignty only exists if you control your keys. If you leave your bitcoin with an exchange or custodian, what you actually hold is an IOU. You can be denied access, frozen out, or rugged just like with a bank.”

He adds: “Mt. Gox was the headline collapse, but it was just one of many rug pulls happening at the time – and sadly, those risks are still with us today as many continue to gamble their future wealth on custodians.”

Not Your Keys Not Your Coins

Mt. Gox was the biggest exchange to fall, but it was by no means the last. As platform after platform was hacked or exit scammed, the risks of relying on third parties to custody cryptocurrency heightened. Five years on from the collapse of Gox, it appeared that users still hadn’t learned their lesson, with the insolvency of QuadrigaCX in 2019 striking a blow to Canadians who’d entrusted it with $145 million of their digital assets.

While Quadriga’s implosion was the most notorious event of 2019, it was just one of many. The year was to notch up 11 exchange hacks or insolvencies in total, providing stark evidence, lest it were needed, of the risks of third-party custodians. But how to stop the rot and get users back to controlling their private keys, the way Bitcoin was originally envisaged?

Bitcoiners advocating this goal felt like they were screaming into the wind, making little headway in getting the message across. Then, Trace Mayer hit upon an idea. As an early Bitcoin investor and monetary historian, he’d been doing his bit to champion self-custody through outlets such as his Bitcoin Knowledge podcast for years. It dawned upon him that the best chance of getting the point across was to funnel the scattershot messaging into a single, media-worthy event. This would amplify the signal and drive it home better than a thousand unfocused entreaties ever could. And thus Proof of Keys day was born.

Recalling the events that prompted the campaign, Trace Meyer notes: “I was just thinking about the concept of “Not your keys, not your coins” and how many users just need a target to help them get started in some way implementing that. And so, this would be a way to help people gain the skills and it would be repeated every year.”

Trace Mayer’s grand vision was to establish a new cultural tradition within the Bitcoin community: a day on which the community would collectively “declare and re-declare our monetary sovereignty” by demanding physical possession of their digital assets. Mayer astutely scheduled the first Proof of Keys day for January 3, 2019, the tenth anniversary of the mining of the Bitcoin genesis block.

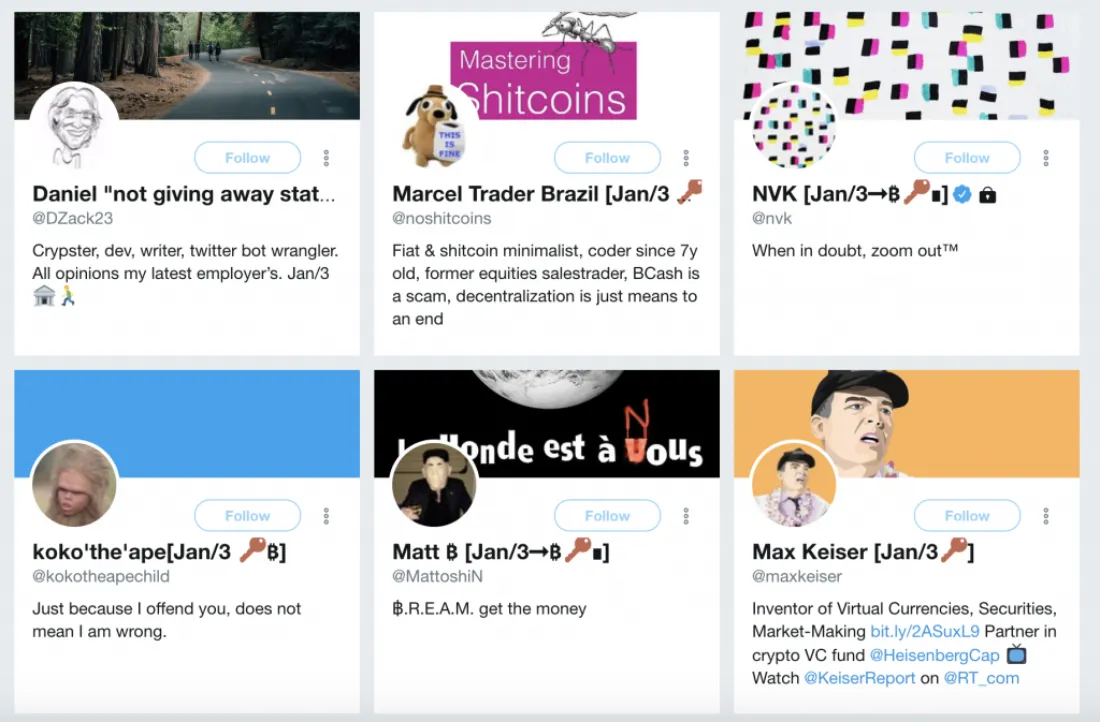

Once the seed was planted, the idea quickly took root, with prominent figures including Nick Szabo and Max Keiser appending [Jan/3 🔑] to their Twitter handles. This visible marker of solidarity served as a signal of broad support from respected voices in the space – a signal that was amplified by thousands more bitcoiners across social media.

“I was slightly surprised by the interest the campaign generated,” observes Meyer at a time when “the industry was still largely retail dominated. Within a few days of Proof of Keys day being announced it had generated a tremendous amount of talk, with many people saying it was “irresponsible.” Coinbase even went to the lengths of moving 600,000+ bitcoins onchain and putting out a press release saying that they were doing so in order not to arouse alarm.”

“What is irresponsible,” he adds, “is a bunch of companies that were running fractional reserves and that could not withstand the scrutiny of users demanding they prove they had the keys to these coins.” On the day itself, participants were encouraged to download a secure non-custodial wallet and withdraw all bitcoin holdings from exchanges and other third-party custodial services.

While the efficacy of the inaugural Proof of Keys day in generating a surge of onchain transactions emanating from exchanges is debatable, as a viral campaign it was a resounding success. Bitcoiners now had an annual opportunity to drive home the importance of self-custody – while also toasting the anniversary of the genesis block.

One industry figure who wholeheartedly supports the Proof of Keys campaign is Bitcoin evangelist and investor Caitlin Long. In her view, “To be a full citizen of the Bitcoin ecosystem, one must both self-custody and run a full Bitcoin node. The cheapest investment in yourself is to learn both.” Her advice to anyone entering the industry is that “The cheapest tuition in life – for most people – is to learn Bitcoin. I'd recommend just diving in and attending local meet-ups. That's how most of us early bitcoiners learned.”

Following the inaugural Proof of Keys day in 2019, Bitcoin users couldn’t claim they weren’t informed of the dangers of third-party custody – even as exchange hacks remained a dominant motif long into the 2020s. Proof of Keys had provided a precious reminder of the value of self-custody – one that persists to this day.

- Artist

- BTC On this day

- January 3, 2019

- Market Cap

- $66,913,066,847

- Block Number

- 556,758

- Hash Rate

- 42,717,899.95 TH/s

- Price Change (1M)

2%

- Price Change (3M)

41%

- Price Change (1Y)

74%