PIRATE SHIP

November 3, 2011

1BTC:$3.152000

- Artist

- Andrea Chiampo

- Fact Date

- November 3, 2011

- Fact #

- 052

- Printing Specifications

- Paper / Stock

- Curious metallics lustre paper

- Page Size

- 70cm x 35cm

Where there’s money, there’s scammers pushing ponzis. It was inevitable that Bitcoin would attract its own unsustainable scheme and it arrived in 2011 with Bitcoin Savings & Trust, operated by a character called Pirate. As it transpired, there were no savings and there was no trust by the time the project evaporated with 150,000 BTC.

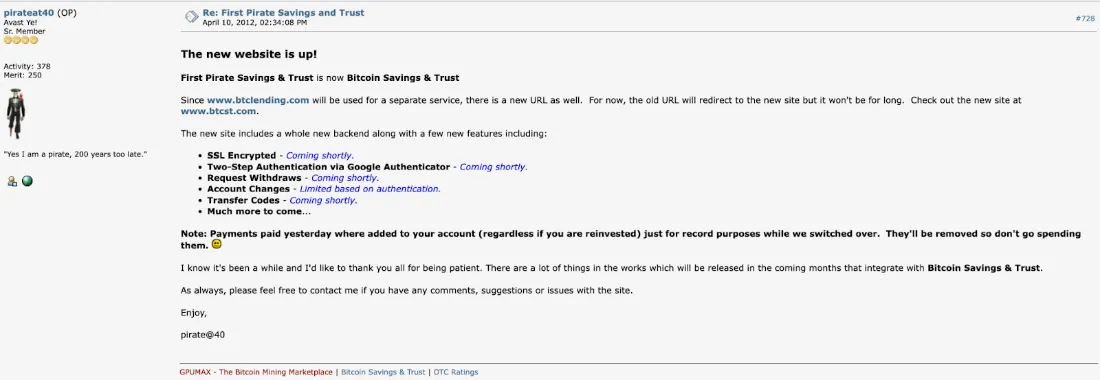

There’s an old saying that goes if an investment sounds too good to be true, it probably is. In hindsight, everything about Bitcoin Savings & Trust (BST), created by forum user “Pirateat40,” was off, from the pseudonym behind it to the promise of 7% weekly interest to users who deposited BTC. That said, these were the free and easy days of Bitcoin, when experimentation was encouraged and pseudonyms were no impediment to raising funds. And with many early miners sitting on thousands of BTC, who can blame them for speculating with some of their haul?

BST got going in November 2011, initially under the name First Pirate Savings & Trust, which ought to have been the first red flag. In fairness, founder Pirateeat40 was an active member of the Bitcointalk forum and had built up a modest reputation through prior trades. He even touted his good standing by pointing to his OTC trading ratings in his forum signature and encouraging potential lenders to check his trust score.

The official story as to how the trust was able to offer such generous returns was due to a group of local Bitcoin buyers with “don’t ask don’t tell” policies who wanted to purchase large volumes of BTC off-market. By borrowing bitcoins from others and selling to these secretive local buyers at a high premium, Pirateat40 could purportedly generate exceptionally high returns. As he explained: “Up until now, I have dealt with my core group of friends... but they seem to be getting larger and more frequent. So now I’m looking into other methods for keeping a consistent storage or on-demand availability of coins.” In other words, he wanted more BTC liquidity to fulfill the growing demand from his buyers. This narrative was used to justify the high interest rates he would pay lenders.

The Sinking of the Pirate Ship

Like all good ponzis, the going was good at first, since early investors could be repaid using the funds provided by later arrivals. Naturally, many within the Bitcoin community were skeptical from the get-go, but then skepticism was not unusual concerning the numerous Bitcoin-based projects the forum spawned back then, and for as long as the trust honoured its pledges, it was hard to dissuade the gullible from putting their coins into it. Especially since earning 7% interest per week would double your investment in just 10 weeks.

Despite the suspicions, Bitcoin Savings & Trust grew rapidly through late 2011 and into 2012. The tantalising promise of 7% weekly interest, aided by Pirateat40’s punctual weekly interest payments to those who joined, led more users to entrust him with their bitcoins. By mid-2012, Pirateat40 claimed that over 500,000 BTC had been deposited into his program, a huge amount that represented over 5% of the entire Bitcoin supply at the scheme’s peak.

On the Bitcointalk forum, users debated BST intensely, with detractors pointing out that a risk-free 7% weekly was mathematically unsustainable and likely a pyramid destined to collapse. One skeptic was so confident BST would fail that they offered large bets on its implosion including a wager of 5,000 BTC directly with Pirateat40 that the scheme would not last.

When a ponzi fails, it tends to do so in spectacular fashion and so it proved to be with Bitcoin Savings & Trust. By summer 2012, the scheme was straining under its own success. To sustain a 7% weekly payout on hundreds of thousands of BTC, Pirate needed a continuous influx of new deposits. On August 14, Pirate quietly announced that the maximum rate on BST accounts would be lowered from 7% to 5% per week, which he likely hoped would slow the exponential growth of his debts. In the event, it merely accelerated the inevitable as depositors panicked, correctly interpreting the cut as a sign of trouble.

A bank run on BST ensued and on August 17 Pirate announced that he was closing down the trust and would commence reimbursing investors. Of course, he was unable to since the trust was around 150,000 BTC in the hole and on August 28 Pirateat40 conceded that he would be defaulting. The market impact was instant, with the price of BTC almost halving over the next three days to around $7.

According to poker player Bryan Micon, one of the forum users who pushed back the hardest against the ponzi, “It reminded me of scams in the poker world: people didn’t want to believe they’d been duped, so they’d get defensive and angry rather than accept the truth. Back then, it was the Wild West of the Wild West. The early Bitcoin community was small, full of libertarians, gold bugs, and anti-fiat types. That made it fertile ground for scams, because some people would believe anything. Over time, the community matured. Coins ended up in stronger hands, the price went way up, and people got more cautious.”

The fallout was to drag on for years, and in 2013 Pirateat40 – by then revealed to be Trendon Shavers – was charged with securities fraud by the SEC. It was the agency’s first SEC enforcement for a Bitcoin-related ponzi and it established that such schemes can fall under existing securities laws. In July 2016, Shavers was sentenced to 18 months in federal prison for the fraud. The rise and fall of Bitcoin Savings & Trust ought to have sent a warning to the community to avoid high-interest schemes, but inevitably more were to come and more investors were to be duped by offers that sounded too good to be true.

- Artist

- BTC On this day

- November 3, 2011

- Market Cap

- $23,914,697

- Block Number

- 193,536

- Hash Rate

- 7.66 TH/s

- Price Change (1M)

36%

- Price Change (3M)

67%

- Price Change (1Y)

1532%