SATOSHI DICE

April 24, 2012

1BTC:$5.098200

- Artist

- Pepenardo

- Fact Date

- April 24, 2012

- Fact #

- 056

- Printing Specifications

- Paper / Stock

- Tintoretto paper

- Page Size

- 70cm x 35cm

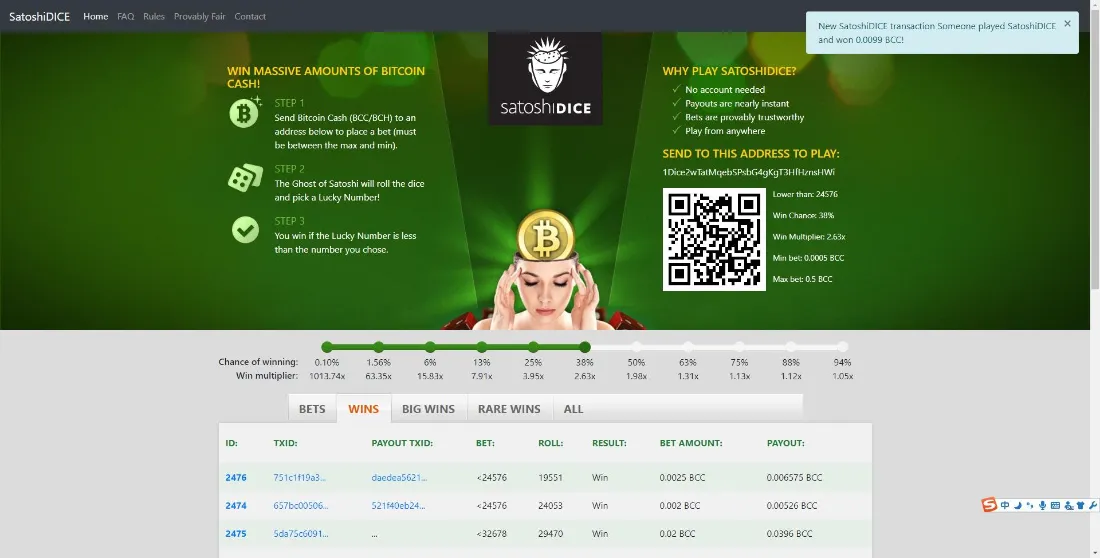

Speculation is Bitcoin’s oldest use case and it ramped up in 2012 with the launch of SatoshiDice. The high-low gambling game sucked players in as blocks filled with SatoshiDice transactions, prompting critics to label it a DDoS attack. Creator Erik Voorhees eventually sold the site for a fortune and went on to launch ShapeShift.

While Bitcoin’s use cases extend far and wide, one area where it found particular traction in its first years was within the black and grey economies. The former concerns commerce that in many countries is deemed illegal, while the latter concerns economic activity that is neither taxed nor closely monitored by governments. SatoshiDice landed slap-bang in the middle.

When Bitcoin became the default currency on Silk Road in 2011, it was very much powering the black economy. Not everything on there was illegal, but a lot of it was and there were certainly no taxes being paid. A year later, though, Bitcoin was to make in-roads into the grey economy by becoming the unit of account for online gambling, an area that had existed on the financial fringes long before the invention of the web.

Launched in April 2012 by prominent early Bitcoiner Erik Voorhees, SatoshiDice was an instant success. Its simple formula, easy access, and lure of making easy money on the roll of a virtual dice appealed to degenerate BTC holders. And when it came to risk, many in the Bitcoin community were very much risk-on. It helped that SatoshiDice provided a tangible use case for Bitcoin at a time when use cases were low. It was gambling, but for many of the initial players, who’d mined stacks of BTC, it felt like playing with fun money.

That’s not to say that players who took to SatoshiDice didn’t appreciate their precious Bitcoin: it’s just that they were willing to risk some of it on the chance of owning even more. With no account or log-in required and all bets paid out instantly, SatoshiDice scored highly for transparency and fairness. It was a formula that was to be emulated by the numerous cryptocurrency casinos that sprung up in subsequent years.

A Roll of the Dice

To play SatoshiDice, the user simply sent BTC to one of the game’s designated addresses, helpfully labelled with a “1dice…” prefix. Each address encoded a specific win probability and payout multiple. The game would then automatically determine win or loss and send a return transaction with the outcome.

Despite the seeming simplicity of SatoshiDice, it was a sophisticated operation that was ahead of its time in terms of the onchain innovations it engendered. SatoshiDice took the hash of the user’s transaction and derived a “lucky number” from the first four bytes of the hash output. If the lucky number fell below a threshold corresponding to the odds of the chosen address, the bet won; otherwise it lost. Because the secret for each day was published afterward, players could verify that the game was provably fair.

With a house edge of around 2%, SatoshiDice wasn’t greedy, which likely contributed to its success. Players felt like they got a fair roll of the dice, and liked the fact that they could shoot for a prize that aligned with their risk profile, ranging from a simple double up to an ultra-low odds 65,000x jackpot.

While gamblers liked what they found with SatoshiDice, a significant proportion of the Bitcoin community were unimpressed – not because of what it represented but on account of what it did to the Bitcoin network. Within two weeks of the game’s launch, half of all Bitcoin transactions emanated from SatoshiDice, causing disgruntled network users to label it as a spam attack.

Despite these complaints, the uptick in onchain activity caused by the game had a number of positives, not least in stress-testing the Bitcoin network. This didn’t stop some Bitcoin developers from taking extreme measures, however, such as attempting to reject transactions from addresses associated with SatoshiDice. It started out as a simple game but evolved into a much larger one that placed Bitcoin’s censorship-resistance under a spotlight.

As Voorhees recounts, the success of SatoshiDice can be attributed to two primary factors: “One is people from anywhere in the world could interact with this service…It didn’t matter their gender or national identity or race or anything. The protocol did not care, does not care who you are. I found that to be very egalitarian and beautiful. Two: SatoshiDice used provable fairness.

“The borderless nature of it and the provable fairness were why SatoshiDice became such a success so quickly…It couldn’t have existed without Bitcoin. So it was just a really early good use case and an example of what it could do.”

In July 2013, Erik Voorhees sold SatoshiDice for 126,315 BTC, worth about $11.5M at the time, and moved on to other things. The game’s influence subsequently began to fade, but at its peak it arguably did more to put Bitcoin on the map than any other service at the time – save for Silk Road. SatoshiDice was famous for many things, not least in its sale by Erik Voorhees marking the first “exit” by a Bitcoin company – and at an eight-figure valuation no less.

- Artist

- BTC On this day

- April 24, 2012

- Market Cap

- $45,111,423

- Block Number

- 176,968

- Hash Rate

- 10.32 TH/s

- Price Change (1M)

12%

- Price Change (3M)

11%

- Price Change (1Y)

227%