SEGWIT ACTIVATION

August 24, 2017

1BTC:$4362.475000

- Artist

- Delainy Jamahl

- Fact Date

- August 24, 2017

- Fact #

- 100

- Printing Specifications

- Paper / Stock

- Tintoretto paper

- Page Size

- 70cm x 35cm

On August 24, 2017, SegWit was activated on the Bitcoin network. The protocol upgrade increased the block size, enabling more transactions to be processed as well as Lightning Network micropayments. Despite these improvements, SegWit was a contentious upgrade that prompted bitter in-fighting in the run-up to its deployment. Despite working perfectly from a technical perspective, from an ideological one, SegWit almost broke Bitcoin.

2017 was the peak of the Bitcoin scaling wars, a time when its community was split due to ideological differences that even threatened to split the chain itself, despatching the factions in opposing directions, each nursing their concept of “the one true Bitcoin.” And if there was one word that embodied that duality it was “SegWit.”

The activation of Segregated Witness (SegWit) on August 24, 2017, ought to have been a simple Bitcoin protocol upgrade. Instead it marked the climactic – though not final – battle in Bitcoin’s multi-year civil war. From a technical perspective, there was nothing especially radical about SegWit. The upgrade addressed “transaction malleability” by solving a minor bug that allowed a third party to intercept an unconfirmed transaction to alter the signature in a way that didn't invalidate it and rebroadcast it.

While this ability didn’t invalidate regular Bitcoin transactions, it risked causing confusion for certain services including cryptocurrency exchanges and L2 solutions such as the Lightning Network. This doesn’t sound like the stuff that community-splitting controversy is made of; nor does SegWit’s other primary feature, which was to increase the amount of data that could be contained in a block, effectively doubling the number of transactions the Bitcoin network could process.

For its proponents, SegWit was an elegant and sorely needed solution to Bitcoin’s scaling challenges, now that the network was seeing heavy usage and fees were rising. To its proponents, however, it was an overly-complex and risky manoeuvre that seemed unnecessary when a far simpler solution could be implemented: double Bitcoin’s block size.

Battlelines Are Drawn

The minutiae of the Bitcoin scaling wars, while largely unknown to subsequent generations of Bitcoiners, mattered a lot to those on the frontlines in 2017 – miners; developers; exchanges; wealthy bitcoiners. The rest of the world, back then, was nonplussed however. And who can blame them? They were still getting to grips with the concept of digital currency; transaction malleability was a step too far.

The upshot of all this in-fighting is that as summer 2017 approached and with it the proposed SegWit upgrade, miners had two options: signal support and allow it to be integrated, or resist it and risk a chain split leading to two competing versions of Bitcoin. Early Bitcoiners who had once worked side-by-side found themselves on opposing sides of an increasingly hostile debate.

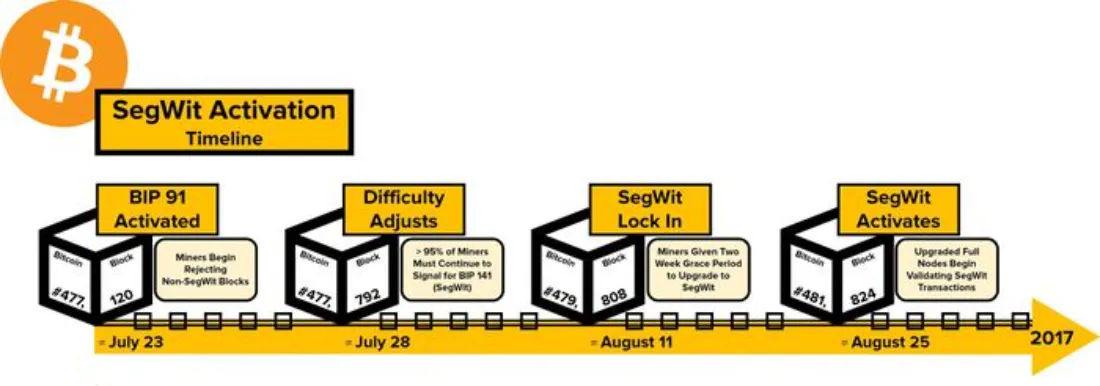

For a long time, a chain split seemed inevitable, which risked not only dividing the Bitcoin network, but causing its price to plummet and disgruntled users to walk away. But with the clock ticking and deadline looming, a majority of miners fell into line and signalled acceptance for SegWit. Many had prevaricated before belatedly consenting to the controversial protocol upgrade with just days to go. When the deadline arrived, SegWit activated and the Bitcoin network continued faithfully producing blocks, just as it always had. Crisis averted.

That ought to have been the end of the matter. But the Big Blockers, whose alternative proposal for scaling Bitcoin had been rejected, initiated a hard fork. This split created a new, parallel blockchain and currency in the form of Bitcoin Cash (BCH), whose larger blocks were rejected by the Bitcoin network, but accepted by nodes running the new Bitcoin ABC software.

Bitcoin had become two, and like any schism, debate rumbled on about which was the “true” Bitcoin: the SegWit version or the big block version known as Bitcoin Cash. History shows that the market ultimately chose SegWit, but it was in many respects a pyrrhic victory.

The war left permanent scars on the community and the debate over Bitcoin's ultimate purpose – as a store of value or a medium of exchange – was left unresolved. This fragmentation, while a testament to the power of open-source rights, diminished the unified network effect that Bitcoin had previously enjoyed. Bitcoin had survived but its community was forever changed.

- Artist

- BTC On this day

- August 24, 2017

- Market Cap

- $72,080,356,461

- Block Number

- 478,559

- Hash Rate

- 7,259,183.918 TH/s

- Price Change (1M)

68%

- Price Change (3M)

94%

- Price Change (1Y)

654%