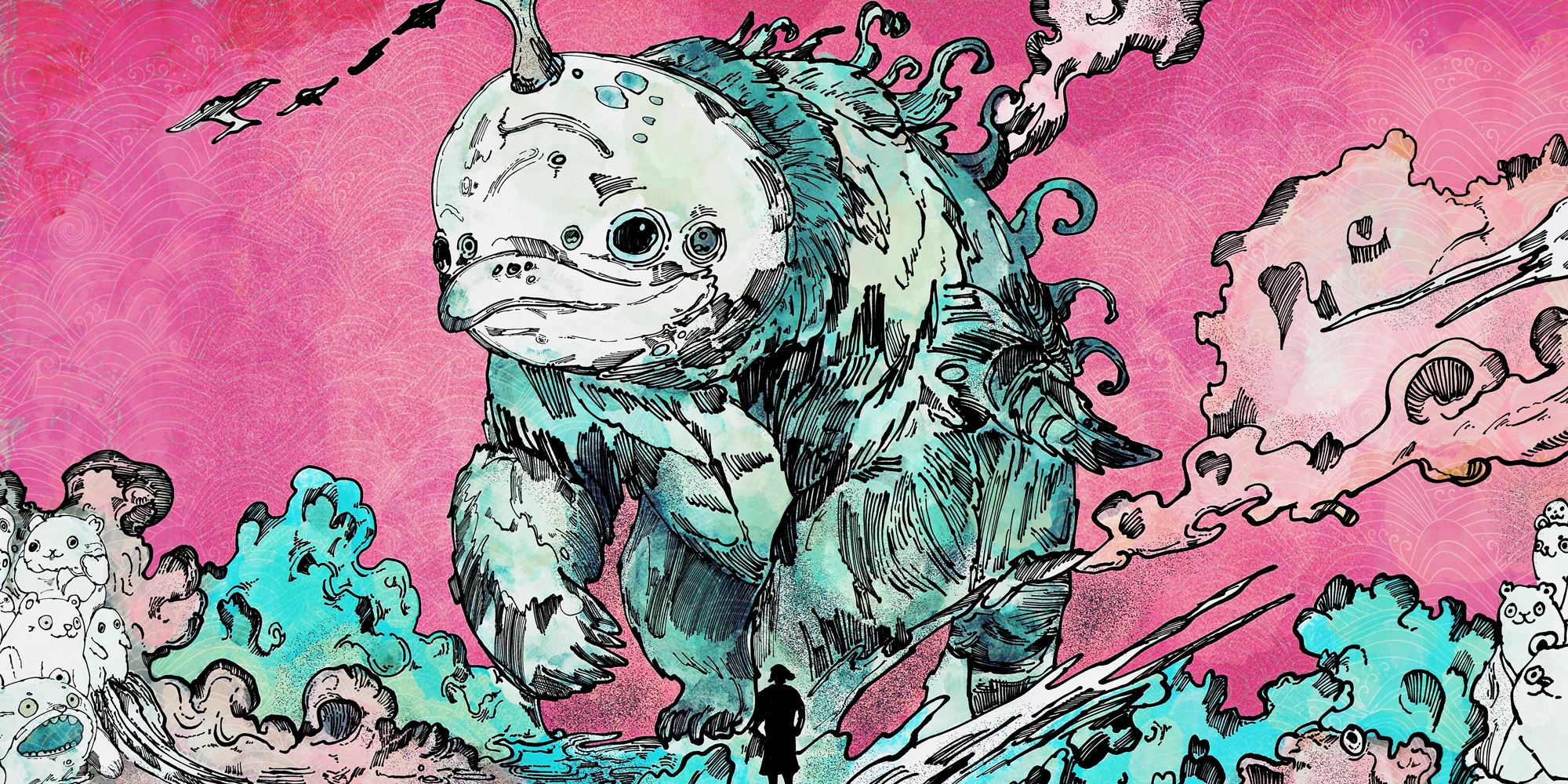

SLAYING THE BEARWHALE

October 6, 2014

1BTC:$328.459400

- Artist

- Archan Nair

- Fact Date

- October 6, 2014

- Fact #

- 089

- Printing Specifications

- Paper / Stock

- Tintoretto paper

- Page Size

- 70cm x 35cm

The bigger the fish, the greater the trophy. In October 2014, a Bitcoin whale placed a huge sell wall of 30,000 BTC. For Bitcoin to rise further, every single one of those coins would need to be bought. The market duly obliged, working together to slay the mysterious “Bearwhale” following an almighty order book battle.

Bitcoin whales today are known for their multi-million dollar holdings, but they rarely have the ability to single-handedly move markets – at least not for an asset as liquid as BTC. But it was different in 2014, not just because Bitcoin was less liquid but because its wealth was significantly concentrated among a number of early adopters who’d built up huge holdings. While many were content to sit on their coins and leave it to others to fight it out on the exchanges, others elected to wade right into the heart of the battle – and few foes came greater than the entity known as Bearwhale.

The foe that traders would have to vanquish for BTC to climb higher was a whale sitting on a stack of 30,000 BTC worth around $9M. To put that into context, daily BTC trading volume in 2014 averaged less than $30M. Bearwhale was the biggest of whales – and he was also the most bearish, since by placing his entire stack into a single $300 sell wall, the market would need to eat up every last coin.

Most traders in a similar situation, even those looking to cash out, would set staggered sell orders at different price points on the chart. Why was Bearwhale so stubborn?

Behind the Bearwhale

It later emerged that Bearwhale's decision to liquidate his holdings was not driven by price action alone. Instead, it was essentially an act of ideological capitulation, driven by loss of faith in the ecosystem due to the block size debate. Years later, he confessed that he had sold his coins because he had been convinced by arguments that Bitcoin was doomed to fail if the block size was not increased. But back in 2014, none of this mattered to traders eyeing the monster sell wall that had appeared on the order books: they were more concerned with working out how to surmount it.

The battle that unfolded on October 6, 2014 provided a public spectacle of market forces played out in real-time. It was an immovable object meeting an unstoppable force and something would have to give. Set on Bitstamp exchange, Bearwhale’s sell wall instantly dropped BTC to the $300 level, effectively pinned by the colossal weight of the sell order. For the next six hours, the price of Bitcoin on Bitstamp, and by extension the world, was locked at $300 as the market grappled with this unprecedented supply.

Bearwhale might have been having fun, but others weren’t so amused. Brendan O'Connor, then managing director of SecondMarket, described it as a “very immaturish way to liquidate that amount of coin” and lamented that it had ruined his Sunday. The battle against the wall was watched intently by a global community. The r/Bitcoin subreddit became the de facto war room, with threads like “introducing the legendary bitcoin whale” gaining thousands of comments. Traders were glued to the Bitstamp order book, treating it like a high-stakes sporting event.

A time-lapse video showing the giant red wall being slowly chipped away by green buy orders would later become an artifact of the six-hour siege, the live commentary capturing the full spectrum of market psychology. Some panicked, seeing the wall as a harbinger of a deeper crash. Others celebrated, viewing it as a once-in-a-lifetime opportunity to acquire cheap coins from a distressed seller.

But the market kept doggedly chipping away and bit by bit the wall was broken down as all 30,000 coins were bought. Bearwhale had been slain but his legend would live long.

“The lesson to be learned from Bearwhale,” observes Bitcoin writer Jamie Redman, “is that there’s always the possibility that a large whale could lose faith in BTC again, and at a specific price range choose to dump billions of dollars of bitcoin.”

- Artist

- BTC On this day

- October 6, 2014

- Market Cap

- $4,385,598,120

- Block Number

- 305,025

- Hash Rate

- 285,449.762 TH/s

- Price Change (1M)

31%

- Price Change (3M)

47%

- Price Change (1Y)

169%