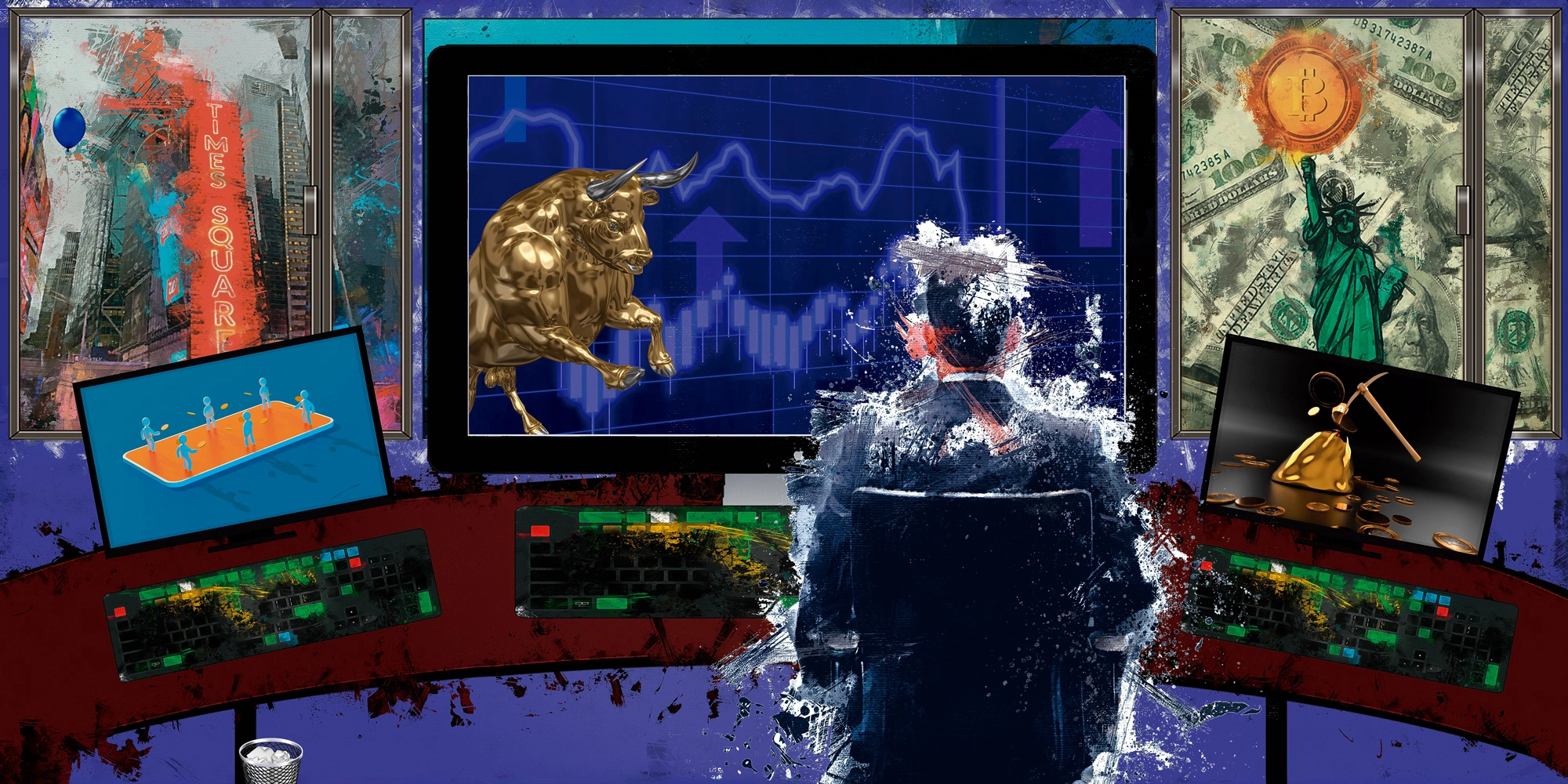

TERMINAL GAINS

April 30, 2014

1BTC:$445.865500

- Artist

- Gala Mirissa

- Fact Date

- April 30, 2014

- Fact #

- 084

- Printing Specifications

- Paper / Stock

- Xper paper

- Page Size

- 70cm x 35cm

You know your magic internet money’s being taken seriously when Bloomberg adds it to its financial Terminal. In April 2014 the once-unthinkable happened when BTC made the grade, jostling for screen space alongside stocks, bonds, and equities. There was no going back now.

There is no single “made it” moment that defines the point at which Bitcoin broke into mainstream finance. But there were a series of milestones that inched BTC closer to the centre of the global financial system. And one of the seemingly smallest, yet most symbolic, came when Bitcoin made it to the desk of Wall Street traders.

Bloomberg Professional Services is a comprehensive platform that provides financial professionals and enterprises with high-quality market data, news, research, and analytics. Its best-known product is Bloomberg Terminal, which serves as the core interface that enables users to monitor markets, perform analysis, and execute trades. In 2013 it was – and still is – the go-to tool for global financial traders, providing a window into the world’s ever-shifting markets. With more than 320,000 subscribers, Bloomberg Professional Services was a prime shop window – but getting in there could be determined by one entity only: Bloomberg.

A Window on the World

Bitcoin’s eventual admission into the Bloomberg club arrived on April 30, 2014. Five years on from the network’s inception, BTC became the first digital currency to get the institutional treatment as it was slotted into Bloomberg Professional Services, joining such established assets as gold, stocks, and Forex. While the achievement was, in the eyes of Bitcoin’s passionate community, long overdue, the timing was nevertheless intriguing.

On the one hand, Bitcoin had been battering its way into public consciousness for the past two years, attracting a combination of curiosity and consternation among politicians, regulators, and Wall Street titans, many of whom didn’t take kindly to this unorthodox new financial asset that had “nothing backing it.” On the other hand, Bitcoin had just been buffeted by the collapse of Mt. Gox, whose liquidation proceedings commenced the very month that Bloomberg gave it the green light. Yes, Bitcoin was new, exciting, and unlike any other asset that had gone before. But the exchange that accounted for 70% of its trading volume had just collapsed and the price was tanking.

While Bloomberg had no interest in propping up Bitcoin, its Terminal listing injected a shot of adrenaline into the highly volatile market. Regardless of where the price of BTC was headed next, it was a signal that the digital currency was now very much on the radar of professional traders. They didn’t need Bloomberg’s endorsement to trade it, but its inclusion provided a highly visible reminder that the digital asset was out there and tradable around the clock.

Bloomberg’s decision to add BTC price data may have been easier to settle upon than the decision of which source to use as its frame of reference. In the event, it went for U.S. exchange Kraken, a decision that its CEO Jesse Powell attributed to his company's relentless focus on building a “stable and compliant cryptocurrency exchange,” concluding that Bloomberg likely “chose to go with people who would be around, who weren't going to be facing either regulatory or criminal problems.”

On its terminal, Bloomberg assigned Bitcoin the ticker symbol XBT. While the universal symbol was BTC, XBT aligned with ISO 4217, the international standard that governs the three-letter currency codes used in global banking. It was a designation that’s stuck. While Bitcoin today is still widely referred to as BTC, in institutional markets it’s XBT. Bitcoin’s ticker might have split, but the world was now united in its fascination with watching the digital currency’s every move.

- Artist

- BTC On this day

- April 30, 2014

- Market Cap

- $5,667,619,303

- Block Number

- 251,113

- Hash Rate

- 58,796.156 TH/s

- Price Change (1M)

2%

- Price Change (3M)

47%

- Price Change (1Y)

220%