THE ORDINAL AWAKENING

December 14, 2022

1BTC:$17802.999000

- Artist

- Sarah Meyohas

- Fact Date

- December 14, 2022

- Fact #

- 123

- Printing Specifications

- Paper / Stock

- Matt coat paper

- Print Finishes

- Gloss laminated

- Page Size

- 70cm x 35cm

Non-fungible tokens began life on Bitcoin as Colored Coins and they returned there over a decade later with Ordinals. Led by former Bitcoin Core contributor Casey Rodarmor, Ordinals support Bitcoin-native NFTs, and have spawned a thriving market for “rare sats” mined in early BTC blocks.

Issuing a digital collectible on a smart contract blockchain like Ethereum is easy. Doing so on Bitcoin is hard – or at least it was until the emergence of Ordinals. Like many Bitcoin breakthroughs, the birth of the Ordinals protocol in late 2022 arose thanks to earlier innovations that made it possible, not least the Taprot upgrade that was deployed on Bitcoin a year earlier.

The origins of Ordinals can be traced back to 2012’s Colored Coins, an open-source protocol to attach metadata to satoshis, effectively turning them into tokens representing anything from stocks to collectibles. Colored Coins was a promising idea but its implementation was suboptimal since Bitcoin’s scripting system wasn’t designed to natively support such meta-assets, and thus maintaining them required external tracking.

But when the Taproot upgrade was deployed in late 2021, Bitcoin’s primitive scripting language also got an upgrade. Now it was possible to encode data into each satoshi forming the smallest unit of a bitcoin – all stored and indexable onchain. Armed with a decade of lessons and newer technology, Ordinals succeeded where Colored Coins had faltered.

At its core was a concept developed by founder Casey Rodarmor called Ordinal Theory: a scheme to give every satoshi a unique serial number – or “ordinal” – based on when it was mined. Ordinal Theory provides a layer of identity for sats without changing those rules. By attaching a piece of data to a specific satoshi, it can be transformed into a unique digital collectible.

Non-Fungibility as a Service

In many respects, Ordinals was the antithesis of Bitcoin’s design, which holds that each sat is fungible and worth the same as any other sat. Ordinals flipped this idea on its head by proposing that while all sats were created equal, some were more equal than others. One that appeared in a coin minted in the genesis block, for example, or in the first transaction sent from Satoshi to Hal Finney, would be particularly desirable according to this thesis.

Ordinal Theory holds that some sats have special birth circumstances and are considered more collectible, with the highest tiers comprising Epic (the first sats contained in each Bitcoin halving event); Legendary (the first sats contained in every six halvings, or once every 24 years); and Mythic (the first satoshi of the genesis block, only one of which exists and which is unspendable).

This “rarity index” gave the community a new way to engage with Bitcoin’s history and, even before any data was inscribed, people began hunting for sats with desirable numbers – for instance, those from historic blocks or with neat patterns. This concept of collectible sats added a new dimension to Bitcoin’s culture, meaning that the value of an NFT on Bitcoin might derive not just from the image or data attached, but also from the provenance of the satoshi carrying it.

Casey Rodarmor astutely designed Ordinals to form a layer on top of Bitcoin’s base layer rather than a change to Bitcoin itself. The Ordinals software runs alongside a Bitcoin Core node and indexes satoshis and inscriptions. This federated approach is similar to how Counterparty operated, but more efficient since it doesn’t require rescanning the entire chain for each update.

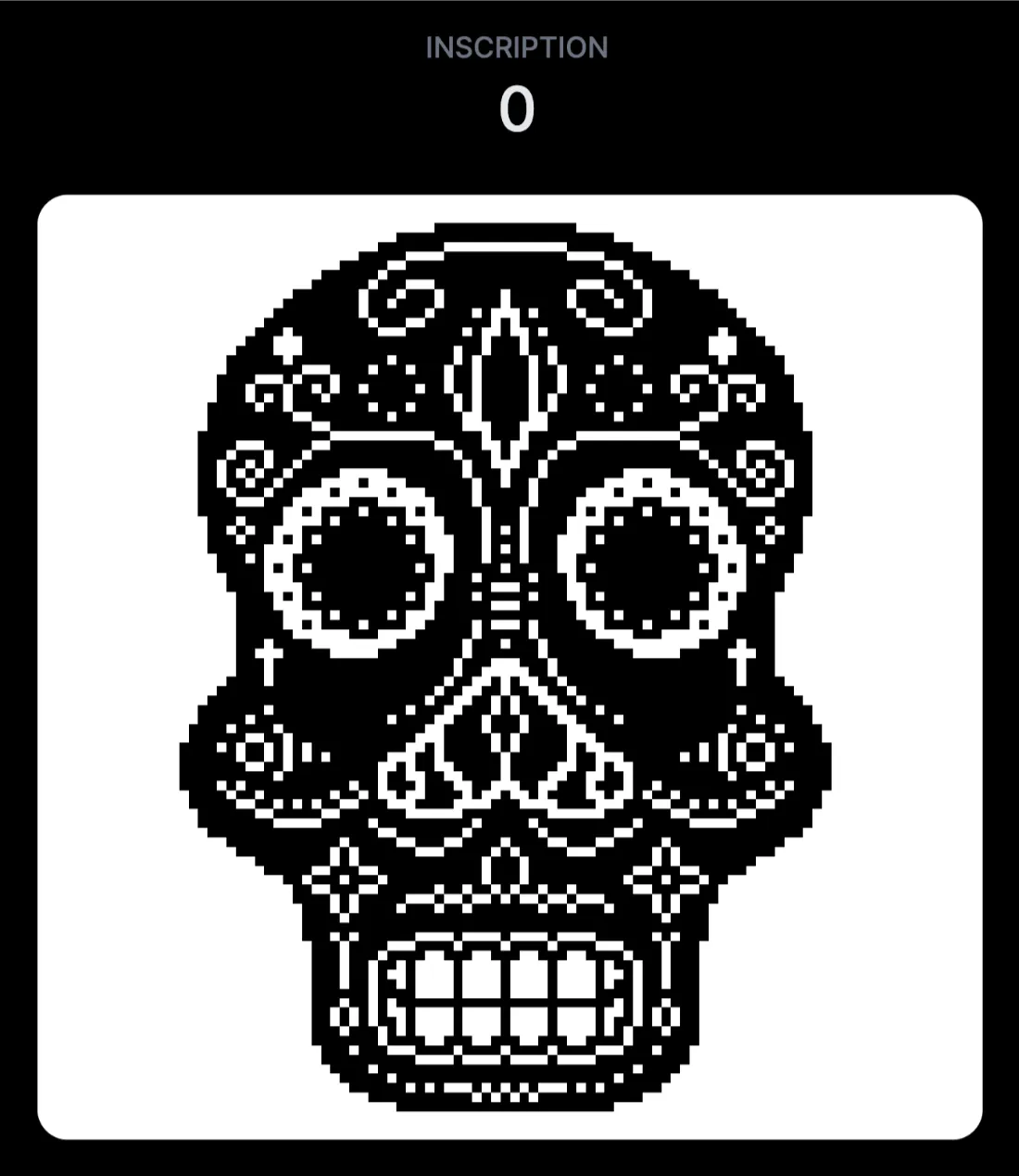

On December 14, 2022, Casey Rodarmor created the first Ordinal inscription on Bitcoin, embedding a black-and-white pixel art skull. Ordinals was born and a month later its protocol was released, accompanied by the launch of the first Ordinals NFT collection, Bitcoin Shrooms.

Within weeks, thousands of inscriptions had been created and by February Ordinals were provoking intense debate as they began filling up Bitcoin block space. In early February 2023, independent developer Udi Wertheimer inscribed a high-resolution “Taproot Wizard” image that nearly filled an entire 4MB block – the largest Bitcoin block ever mined at the time. Just weeks after Ordinals launched, Ordinal Punks – 100 pixel-art avatars riffing on Ethereum’s CryptoPunks – were launched and quickly became coveted digital collectibles on Bitcoin. In early February 2023, one Ordinal Punk sold for 9.5 BTC.

Some people loved the new Bitcoin use case that had seemingly emerged from nowhere; others hated it with an equal passion, but the beauty of Bitcoin’s design is that those who wished to ignore the phenomenon could do so: nothing had changed from a user perspective. The Bitcoin blockchain still worked as flawlessly as ever for the purposes of sending and receiving BTC.

“A curious side story about SegWit,” relates journalist Christoph Bergmann, “Is that it was created by Luke Dashjr, Pieter Wuille, and Gregory Maxwell with the explicit goal of keeping Bitcoin as secure “p2p digital cash” and preventing non-monetary transactions. It was activated in 2017 and followed a few years later by Gregory Maxwell introducing Taproot, which allows large Ordinals files to be uploaded. As a result, the “withess-discount” SegWit introduced has now become a discount for non-monetary transactions, so that Luke Dashjr, the inventor of the discount, blocks transactions for the technology he created with his pool.”

Just 45 days after launching, Ordinals reached the milestone of 100,000 inscriptions and the protocol was integrated into Magic Eden’s NFT marketplace. Ordinals had succeeded where other attempts at issuing non-fungible assets on Bitcoin had failed. For the first time in over a decade, Bitcoin had a major new use case and an influx of new users to support.

- Artist

- BTC On this day

- December 14, 2022

- Market Cap

- $342,421,881,347

- Hash Rate

- 260,233,159.125 TH/s

- Price Change (1M)

7%

- Price Change (3M)

9%

- Price Change (1Y)

63%